ESTIMATED TAX PENALTY

If you do not pay enough estimated tax, a penalty may be charged

unless you meet one of the exceptions. Use Schedule K-220 to figure

any underpayment of estimated tax, to determine if you meet an

exception to the penalty, and to figure any penalty due. The penalty

2016

is based on the unpaid balance of estimated tax from the due date

Corporate Estimated Tax

of the installment to: 1) the date the installment was paid, or 2) the

original due date of the return, whichever is earlier.

“Underpayment of tax” means the difference between the amount

of tax actually paid and the amount of tax which would have been

required to be paid to avoid penalty.

Schedule K-220 is available from the department’s website at:

HOW TO FILE YOUR ESTIMATED TAX

To ensure the most efficient processing of your payments, it is

important that you use only black ink to complete the vouchers.

1) Complete the enclosed worksheet to

calculate your estimated tax for tax year

Need to make a

2016.

quick payment?

2) Be sure to use the correct voucher for

It’s simple — pay

WHAT ARE ESTIMATED TAX PAYMENTS

your estimated tax

the quarter in which you are remitting

electronically. Visit

A corporation is required to make estimated tax payments for

payment. Enter all required information,

the taxable year if its Kansas income tax liability can reasonably

including the amount of your payment.

be expected to exceed $500. A corporation is not required to file a

and get started.

3) Write your federal Employer Identification

declaration of estimated tax in its first year of existence in Kansas.

Number (EIN) on your check or money

order and make payable to: Kansas

WHEN TO FILE YOUR ESTIMATED TAX VOUCHERS

Corporate Estimated Tax.

4) Send the voucher and payment to: Corporate Estimated Tax,

Corporate estimated tax vouchers are due on or before the 15th

day of the fourth, sixth, ninth, and twelfth months of the corporate

Kansas Department of Revenue, 915 SW Harrison Street,

taxable year without any regard to an extension of time to file for the

Topeka, KS 66612-1588.

prior year’s income tax return.

If you need assistance completing your vouchers, contact the

SHORT TAXABLE YEARS: Any estimated tax, payable in

Kansas Department of Revenue at 785-368-8222.

installments, not paid before the 15th day of the last month of

a short taxable year (less than 12 months) must be paid on the

AMENDED PAYMENTS

15th day of the last month of the short taxable year. If the short

taxable year is less than three and one-half months, an estimated

If you missed a payment or if you made a mistake which caused an

voucher and tax payment are not required.

underpayment in earlier installments, make an immediate payment to

balance your account. The amendment of a voucher will not prevent

When the due date falls on a Saturday, Sunday, or legal holiday,

imposition of a penalty on the previous installments.

substitute the next regular workday.

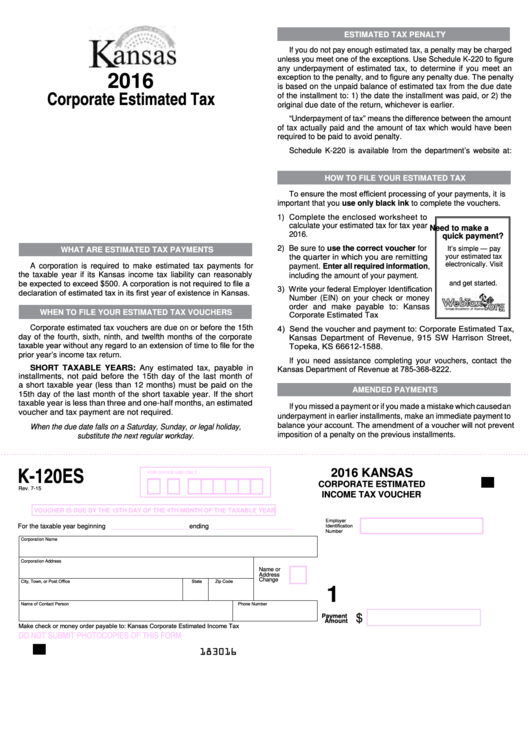

K-120ES

2016 KANSAS

FOR OFFICE USE ONLY

CORPORATE ESTIMATED

Rev. 7-15

INCOME TAX VOUCHER

VOUCHER IS DUE BY THE 15TH DAY OF THE 4TH MONTH OF THE TAXABLE YEAR

Employer

Identification

__________________

For the taxable year beginning

____________________

ending

Number

Corporation Name

Corporation Address

Name or

Address

Change

City, Town, or Post Office

State

Zip Code

1

Name of Contact Person

Phone Number

Payment

$

Amount

Make check or money order payable to: Kansas Corporate Estimated Income Tax

DO NOT SUBMIT PHOTOCOPIES OF THIS FORM

183016

1

1 2

2 3

3