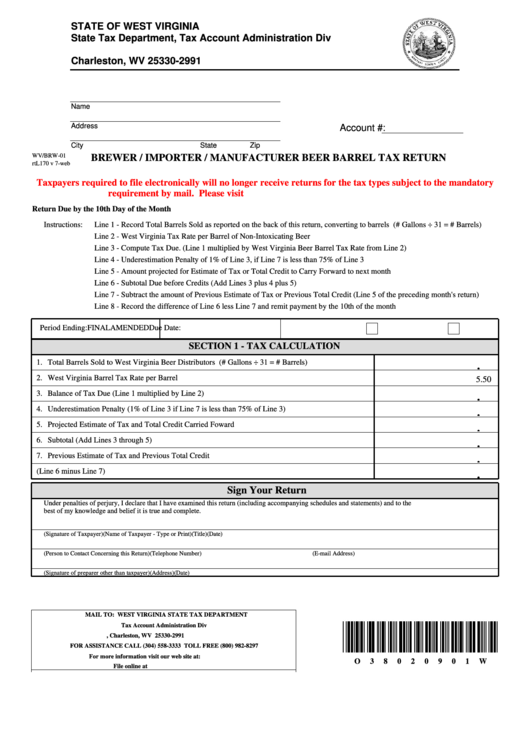

STATE OF WEST VIRGINIA

State Tax Department, Tax Account Administration Div

P.O. Box 2991

Charleston, WV 25330-2991

Name

Address

Account #:

City

State

Zip

WV/BRW-01

BREWER / IMPORTER / MANUFACTURER BEER BARREL TAX RETURN

rtL170 v 7-web

Taxpayers required to file electronically will no longer receive returns for the tax types subject to the mandatory

requirement by mail. Please visit for additional information.

Return Due by the 10th Day of the Month

Instructions:

Line 1 - Record Total Barrels Sold as reported on the back of this return, converting to barrels (# Gallons ÷ 31 = # Barrels)

Line 2 - West Virginia Tax Rate per Barrel of Non-Intoxicating Beer

Line 3 - Compute Tax Due. (Line 1 multiplied by West Virginia Beer Barrel Tax Rate from Line 2)

Line 4 - Underestimation Penalty of 1% of Line 3, if Line 7 is less than 75% of Line 3

Line 5 - Amount projected for Estimate of Tax or Total Credit to Carry Forward to next month

Line 6 - Subtotal Due before Credits (Add Lines 3 plus 4 plus 5)

Line 7 - Subtract the amount of Previous Estimate of Tax or Previous Total Credit (Line 5 of the preceding month's return)

Line 8 - Record the difference of Line 6 less Line 7 and remit payment by the 10th of the month

Period Ending:

Due Date:

FINAL

AMENDED

SECTION 1 - TAX CALCULATION

1.

Total Barrels Sold to West Virginia Beer Distributors (# Gallons ÷ 31 = # Barrels)

.

2.

West Virginia Barrel Tax Rate per Barrel

5.50

3.

Balance of Tax Due (Line 1 multiplied by Line 2)

.

4.

Underestimation Penalty (1% of Line 3 if Line 7 is less than 75% of Line 3)

.

5.

Projected Estimate of Tax and Total Credit Carried Foward

.

6.

Subtotal (Add Lines 3 through 5)

.

7.

Previous Estimate of Tax and Previous Total Credit

.

8. TOTAL TAX DUE (Line 6 minus Line 7)

.

Sign Your Return

Under penalties of perjury, I declare that I have examined this return (including accompanying schedules and statements) and to the

best of my knowledge and belief it is true and complete.

(Signature of Taxpayer)

(Name of Taxpayer - Type or Print)

(Title)

(Date)

(Person to Contact Concerning this Return)

(Telephone Number)

(E-mail Address)

(Signature of preparer other than taxpayer)

(Address)

(Date)

MAIL TO: WEST VIRGINIA STATE TAX DEPARTMENT

Tax Account Administration Div

P.O. Box 2991, Charleston, WV 25330-2991

FOR ASSISTANCE CALL (304) 558-3333 TOLL FREE (800) 982-8297

For more information visit our web site at:

O

3

8

0

2

0

9

0

1

W

File online at https://mytaxes.wvtax.gov

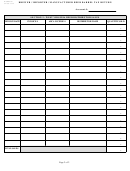

1

1 2

2