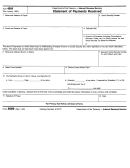

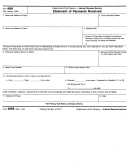

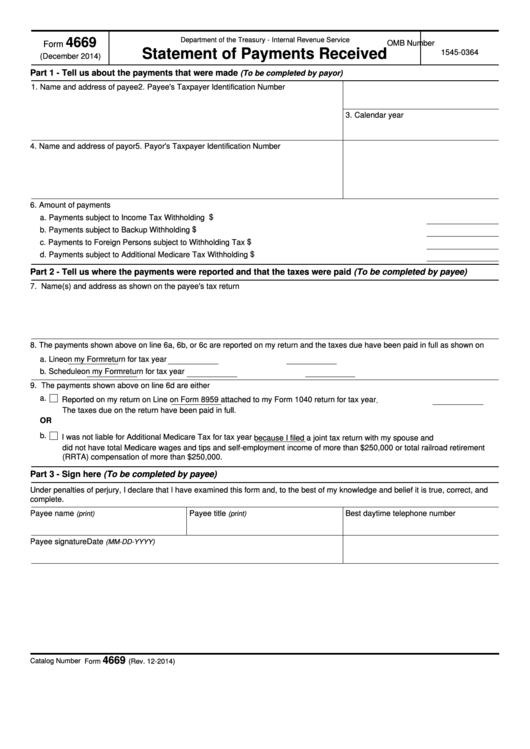

4669

Department of the Treasury - Internal Revenue Service

OMB Number

Form

Statement of Payments Received

1545-0364

(December 2014)

Part 1 - Tell us about the payments that were made

(To be completed by payor)

1. Name and address of payee

2. Payee's Taxpayer Identification Number

3. Calendar year

4. Name and address of payor

5. Payor's Taxpayer Identification Number

6. Amount of payments

$

a. Payments subject to Income Tax Withholding

$

b. Payments subject to Backup Withholding

$

c. Payments to Foreign Persons subject to Withholding Tax

$

d. Payments subject to Additional Medicare Tax Withholding

Part 2 - Tell us where the payments were reported and that the taxes were paid (To be completed by payee)

7. Name(s) and address as shown on the payee's tax return

8. The payments shown above on line 6a, 6b, or 6c are reported on my return and the taxes due have been paid in full as shown on

a. Line

on my Form

return for tax year

b. Schedule

on my Form

return for tax year

9. The payments shown above on line 6d are either

a.

Reported on my return on Line

on Form 8959 attached to my Form 1040 return for tax year

.

The taxes due on the return have been paid in full.

OR

b.

I was not liable for Additional Medicare Tax for tax year

because I filed a joint tax return with my spouse and

did not have total Medicare wages and tips and self-employment income of more than $250,000 or total railroad retirement

(RRTA) compensation of more than $250,000.

Part 3 - Sign here (To be completed by payee)

Under penalties of perjury, I declare that I have examined this form and, to the best of my knowledge and belief it is true, correct, and

complete.

Payee name

Payee title

Best daytime telephone number

(print)

(print)

Payee signature

Date

(MM-DD-YYYY)

4669

Catalog Number 41877Z

Form

(Rev. 12-2014)

1

1