Form JFT-4U Instructions

All persons storing or selling aircraft (jet) fuel within municipalities

All licensees are required to complete page 1, lines 1 through 8.

adopting the provisions of Chapter 64J of the Massachusetts Gen-

1. Beginning inventory. Include all gallons on hand as of the first

eral Laws are required to be licensed with the Massachusetts De-

day of the month.

partment of Revenue, and file monthly tax returns. A tax return is

due, even if no liability exists.

2. Receipts. From Schedule A, enter the total of all bulk purchases

of aircraft (jet) fuel made during the month.

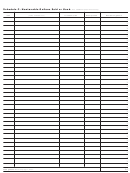

Schedule A, Receipts. Indicate date of purchase, name and ad-

dress of supplier, point of origin, price per gallon, tax-paid gallons

3. Total available gallons. Add Iines 1 and 2.

and tax-free gallons. Enter in line 2 the total of all gallons purchased

4. Ending inventory. Enter the number of gallons on hand as of the

during the month.

last day of the month.

Schedule B, Taxable Gallons Sold or Used. Enter date, name

5. Total gallons disposed of. Subtract line 4 from line 3.

and address of purchaser, location code, price per gallon charged

exclusive of tax, and number of gallons sold or used. Enter in line 6

6. Taxable gallons sold or used. From Schedule B, enter the total

the total of taxable gallons sold.

number of taxable gallons of aircraft fuel sold or used during the

month.

Schedule C, Nontaxable Gallons Sold or Used. Enter date, name

and address of purchaser, location code, exemption code (see at-

7. From Schedule C, enter nontaxable gallons sold or used.

tached listing of valid exempt codes), and number of gallons sold or

8. Total gallons. Add lines 6 and 7.

used. Enter in line 7 the total of nontaxable gallons sold.

Be sure to sign and date the return.

100 9/10 CPSERV3195OSD2011001

printed on recycled paper

1

1 2

2 3

3 4

4