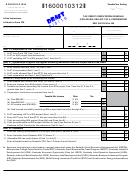

Schedule Kesa (Form 41a720kesa) - Tax Credit Computation Schedule (For A Kesa Project Of A Corporation) Page 2

ADVERTISEMENT

Page 2

41A720KESA (10-13)

Commonwealth of Kentucky

DEPARTMENT OF REVENUE

INSTRUCTIONS—SCHEDULE KESA

The KESA tax credit is applied against the corporation income tax imposed by KRS 141.040 and/or the limited liabil-

ity entity tax (LLET) imposed by KRS 141.0401. The amount of tax credit against each tax can be different; however,

for tracking purposes, the maximum amount of credit used against either tax is the amount that is used for the tax

year.

PURPOSE OF SCHEDULE—For taxable years ending

Line 2—This is the LLET imposed by KRS 141.0401 on

on or after June 4, 2010, this schedule is used by

the corporation for the base year (not applicable for

a corporation which has an approved Kentucky

years beginning before January 1, 2007).

Environmental Stewardship Act (KESA) project

as provided by KRS 154.48–025 to determine the

Line 3—This is the LLET credit permitted by KRS

environmental stewardship tax credit allowed against

141.0401(3) for the base year (not applicable for years

its corporation income tax and LLET attributable to the

beginning before January 1, 2007).

project in accordance with KRS 141.430.

Part II—Current Year Net Tax

KRS 141.430(2) provides that for each taxable year

beginning with the year in which the activation date

Enter the tax computed before the application of any

defined in KRS 154.48–010(1) occurs and ending with

tax credits.

the year in which the project terminates, a corporation’s

environmental stewardship tax credit is determined

Line 1—This is the income tax imposed by KRS 141.040

by subtracting the base year tax from the current year

on the taxable net income of the corporation for the

combined corporation income tax and LLET; however,

current taxable year.

the tax credit claimed for any single tax year cannot

exceed 25% of the total authorized inducement. The

Line 2—This is the LLET imposed by KRS 141.0401 on

base year tax is the combined corporation income tax

the corporation for the current taxable year.

and LLET for the first taxable year after December 31,

2005, that ends immediately prior to the activation date.

Line 3—This is the LLET credit permitted by KRS

If the base year is for a taxable year beginning before

141.0401(3) for the current taxable year.

January 1, 2007, the LLET will not apply. For taxable

years ending on or after June 4, 2010, the base year

Part III—KESA Credit

tax is reduced by fifty percent (50%).

Line 3—This is the lesser of Part III, Line 1 or Line 2,

GENERAL INSTRUCTIONS

but not more than the amount of credit allowed against

the LLET.

Part I—Base Year Net Tax

Line 4—This is the lesser of Part III, Line 1 or Line 2,

Enter the tax computed before the application of any

but not more than the amount of credit allowed against

tax credits.

the income tax.

Line 1—This is the income tax imposed by KRS 141.040

For this taxable year, enter on Schedule KESA-T,

on the taxable net income of the corporation for the

Column C the greater of Part III, Line 3 or Part III,

base year.

Line 4.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2