Tab to navigate within form. Use mouse to check

Save

Print

Clear

applicable boxes, press spacebar or press Enter.

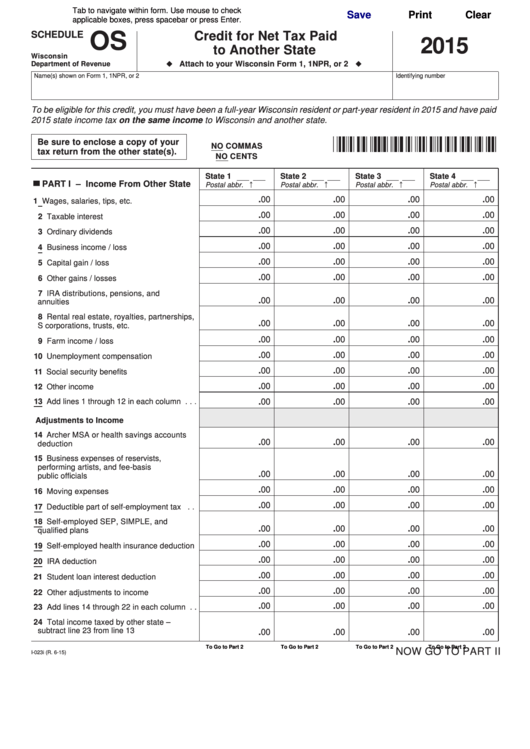

SCHEDULE

OS

Credit for Net Tax Paid

2015

to Another State

Wisconsin

u

u

Attach to your Wisconsin Form 1, 1NPR, or 2

Department of Revenue

Name(s) shown on Form 1, 1NPR, or 2

Identifying number

To be eligible for this credit, you must have been a full-year Wisconsin resident or part-year resident in 2015 and have paid

2015 state income tax on the same income to Wisconsin and another state.

Be sure to enclose a copy of your

NO COMMAS

tax return from the other state(s).

NO CENTS

State 1

State 2

State 3

State 4

▀ PART I – Income From Other State

Postal abbr. ↑

Postal abbr. ↑

Postal abbr. ↑

Postal abbr. ↑

.00

.00

.00

.00

1 Wages, salaries, tips, etc. . . . . . . . . . . . . .

.00

.00

.00

.00

2 Taxable interest . . . . . . . . . . . . . . . . . . . . .

.00

.00

.00

.00

3 Ordinary dividends . . . . . . . . . . . . . . . . . .

.00

.00

.00

.00

4 Business income / loss . . . . . . . . . . . . . . .

.00

.00

.00

.00

5 Capital gain / loss . . . . . . . . . . . . . . . . . . .

.00

.00

.00

.00

6 Other gains / losses . . . . . . . . . . . . . . . . .

7 IRA distributions, pensions, and

.00

.00

.00

.00

annuities . . . . . . . . . . . . . . . . . . . . . . . . . .

8 Rental real estate, royalties, partnerships,

.00

.00

.00

.00

S corporations, trusts, etc. . . . . . . . . . . . .

.00

.00

.00

.00

9 Farm income / loss . . . . . . . . . . . . . . . . . .

.00

.00

.00

.00

10 Unemployment compensation . . . . . . . . . .

.00

.00

.00

.00

11 Social security benefits . . . . . . . . . . . . . . .

.00

.00

.00

.00

12 Other income . . . . . . . . . . . . . . . . . . . . . . .

13 Add lines 1 through 12 in each column . . .

.00

.00

.00

.00

Adjustments to Income

14 Archer MSA or health savings accounts

.00

.00

.00

.00

deduction . . . . . . . . . . . . . . . . . . . . . . . . . .

15 Business expenses of reservists,

performing artists, and fee-basis

.00

.00

.00

.00

public officials . . . . . . . . . . . . . . . . . . . . . .

.00

.00

.00

.00

16 Moving expenses . . . . . . . . . . . . . . . . . . .

.00

.00

.00

.00

17 Deductible part of self-employment tax . .

18 Self-employed SEP, SIMPLE, and

.00

.00

.00

.00

qualified plans . . . . . . . . . . . . . . . . . . . . . .

.00

.00

.00

.00

19 Self-employed health insurance deduction

.00

.00

.00

.00

20 IRA deduction . . . . . . . . . . . . . . . . . . . . . .

.00

.00

.00

.00

21 Student loan interest deduction . . . . . . . . .

.00

.00

.00

.00

22 Other adjustments to income . . . . . . . . . .

.00

.00

.00

.00

23 Add lines 14 through 22 in each column . .

24 Total income taxed by other state –

subtract line 23 from line 13 . . . . . . . . . . .

.00

.00

.00

.00

Click Here To Go to Part 2

Click Here To Go to Part 2

Click Here To Go to Part 2

Click Here To Go to Part 2

NOW GO TO PART II

I-023i (R. 6-15)

1

1 2

2