3

Schedule D (Form 990) 2015

Page

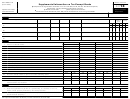

Part VII

Investments—Other Securities.

Complete if the organization answered “Yes” on Form 990, Part IV, line 11b. See Form 990, Part X, line 12.

(a) Description of security or category

(b) Book value

(c) Method of valuation:

(including name of security)

Cost or end-of-year market value

(1) Financial derivatives

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

(2) Closely-held equity interests .

.

.

.

.

.

.

.

.

.

.

.

.

(3) Other

(A)

(B)

(C)

(D)

(E)

(F)

(G)

(H)

Total. (Column (b) must equal Form 990, Part X, col. (B) line 12.)

▶

Part VIII

Investments—Program Related.

Complete if the organization answered “Yes” on Form 990, Part IV, line 11c. See Form 990, Part X, line 13.

(a) Description of investment

(b) Book value

(c) Method of valuation:

Cost or end-of-year market value

(1)

(2)

(3)

(4)

(5)

(6)

(7)

(8)

(9)

Total. (Column (b) must equal Form 990, Part X, col. (B) line 13.)

▶

Part IX

Other Assets.

Complete if the organization answered “Yes” on Form 990, Part IV, line 11d. See Form 990, Part X, line 15.

(a) Description

(b) Book value

(1)

(2)

(3)

(4)

(5)

(6)

(7)

(8)

(9)

Total. (Column (b) must equal Form 990, Part X, col. (B) line 15.) .

.

.

.

.

.

.

.

.

.

.

.

.

.

▶

Part X

Other Liabilities.

Complete if the organization answered “Yes” on Form 990, Part IV, line 11e or 11f. See Form 990, Part X,

line 25.

1.

(a) Description of liability

(b) Book value

(1) Federal income taxes

(2)

(3)

(4)

(5)

(6)

(7)

(8)

(9)

Total. (Column (b) must equal Form 990, Part X, col. (B) line 25.)

▶

2. Liability for uncertain tax positions. In Part XIII, provide the text of the footnote to the organization’s financial statements that reports the

organization’s liability for uncertain tax positions under FIN 48 (ASC 740). Check here if the text of the footnote has been provided in Part XIII

Schedule D (Form 990) 2015

1

1 2

2 3

3 4

4 5

5