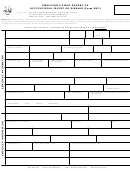

State of Rhode Island

PLEASE CHECK IF CORRECTION OF PRIOR REPORT

PART-TIME WAGE STATEMENT

(Hired for less than 20 hours per week)

DWC No.

Department of Labor and Training, Division of Workers' Compensation

PO Box 20190, Cranston, RI 02920-0942

Phone (401) 462-8100 TDD (401) 462-8006

Insurer File No.

EMPLOYEE INFORMATION:

CLAIM INFORMATION:

SSN

Employer

Name

Insurance Co.

Hired for________ hours each week (

Claim Administrator

Approximate)

Are these supplemental wages?

Yes

No

Injury date

If yes, name of supplemental employer

Incapacity date

Maximum no. of exemptions_______

Hire date

Single

Married

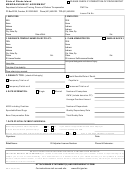

EMPLOYED LESS THAN 2 WEEKS:

If Yes:

OR:

1. List agreed upon hourly wage

2. Number of hrs. per week for part-time employees

Give average weekly for same or similar employment:

3. Multiply #1 by #2 for average weekly wage

EMPLOYED MORE THAN 2 WEEKS:

On the left side of the form, list gross wages prior to employee's first full day out of work. DO NOT include their week of hire or week of injury unless a full

week was paid. DO NOT SKIP WEEKS. Please calculate any overtime and/or bonus paid SEPARATELY on the right side of the form below.

LIST 26 CONSECUTIVE WEEKS:

BONUS AND OVERTIME CALCULATION:

No. of standard

Gross Wages

Block 1

Week Number

Week Ending Date

Number of weeks employed (up to 52)

hrs. worked

(No Overtime)

1

Block 2

Total BONUS amount paid in past 52 weeks

2

3

Block 3

4

Divide Block 2 by Block 1 for average bonus

5

6

7

Block 4

8

Total OVERTIME amount paid in past 52 weeks

9

Block 5

10

Divide Block 4 by Block 1 for average overtime

11

12

13

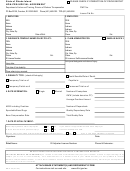

CALCULATION OF AVERAGE WEEKLY WAGE (AWW):

14

15

16

1. Total earnings from 26 weeks

17

18

2. Total number usable weeks

19

20

3. Divide total earnings by number of usable weeks

21

22

4. Average bonus (Block 3 in BONUS AND OT)

23

24

5. Add 3 and 4 for AWW excluding Overtime

$

25

26

6. Average overtime (Block 5 in BONUS AND OT)

Total number

Total earnings:

7. Add 5 and 6 for Total Average Weekly Wage

$

usable weeks:

Print Preparer Name:

Date:

Print Adjuster Name:

Date:

For instructions visit our web site:

DWC-03P (01/03)

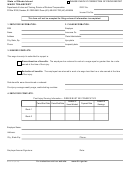

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18