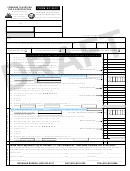

SC1120U

Page 2

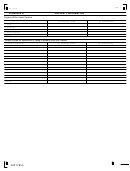

ADDITIONS TO FEDERAL TAXABLE INCOME

SCHEDULE A AND B

1.

1. Taxes on or Measured By Income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2. Federal Net Operating Loss . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2.

3.

3.

4.

4.

5. Other Additions (attach schedule) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5.

6. Total Additions (add lines 1 through 5) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6.

DEDUCTIONS FROM FEDERAL TAXABLE INCOME

7. Interest On Obligations Of The U.S. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7.

8.

8.

9.

9.

10. Other Deductions (attach schedule) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10.

11. Total Deductions (add lines 7 through 10). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11.

12.

12. Net Adjustment (line 6 less line 11) Also enter on line 2, Part 1, SC1120U . . . . . . . . . . . . . . . . . . . . . . . . . . . .

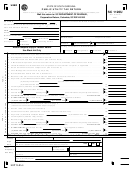

SCHEDULE C

SUMMARY OF CREDITS (FROM SC1120-TC)

1.

.

1.

Credit Carryover From Previous Year's SC1120U, Schedule C

(NOTE: Should agree to SC1120-TC Column A, line 16)

2. Enter Total Credits from SC1120-TC, Column B, line 16. SC1120-TC must be attached to return . . . . . . . . . .

2.

3. Total Credits (add lines 1 and 2). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3.

4. Tax (line 7, Part 1, SC1120U). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4.

5. Lesser of line 3 or 4 (enter on line 8, Part 1, SC1120U) (

5.

NOTE:

Should agree to SC1120-TC, Column C, line 16.)

. .

6.

Enter Credits Lost Due to Statute (NOTE: Should agree to SC1120-TC, Column D, line 16.) . . . . . . . . . . . . . . . . . . .

6.

7.

7. Credit Carryover (line 3 less lines 5 and 6) (NOTE: Should agree to SC1120-TC, Column E, line 16.). . . . . . . . . . . . .

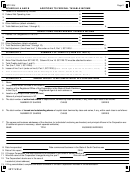

SCHEDULE D

ANNUAL REPORT TO BE COMPLETED BY ALL CORPORATIONS

1. Name

2.

Incorporated under the laws of the State of

3. Location of the Registered Office of the Corporation in the State of South Carolina is

In the City of

Registered Agent at such address is

4. Location of principal office (street address)

Nature of principal business in SC

5. The total number of authorized shares of capital stock, itemized by class and series, if any, within each class is as follows:

NUMBER OF SHARES

CLASS

SERIES

6. The total number of issued and outstanding shares of capital stock itemized by class and series, if any, within each class is as follows:

NUMBER OF SHARES

CLASS

SERIES

7. The names and business addresses of the directors (or individuals functioning as directors) and principal officers in the Corporation are:

(If additional space is necessary, attach separate schedule).

NAME

TITLE

BUSINESS ADDRESS

8. Date Incorporated

Date commenced business in the State of South Carolina was

9. Date of this report

FEIN

10. If Foreign Corporation, the date qualified to do business in the State of South Carolina is

11. Was the name of the Corporation changed during the year?

Give old name

12. The Corporation's books are in the care of

Located at (street address)

13. If filing consolidated, complete and attach Schedule J for each Corporation included in the consolidation.

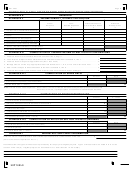

30972012

1

1 2

2 3

3 4

4 5

5 6

6 7

7