Employer'S Wage Statement

Download a blank fillable Employer'S Wage Statement in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Employer'S Wage Statement with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

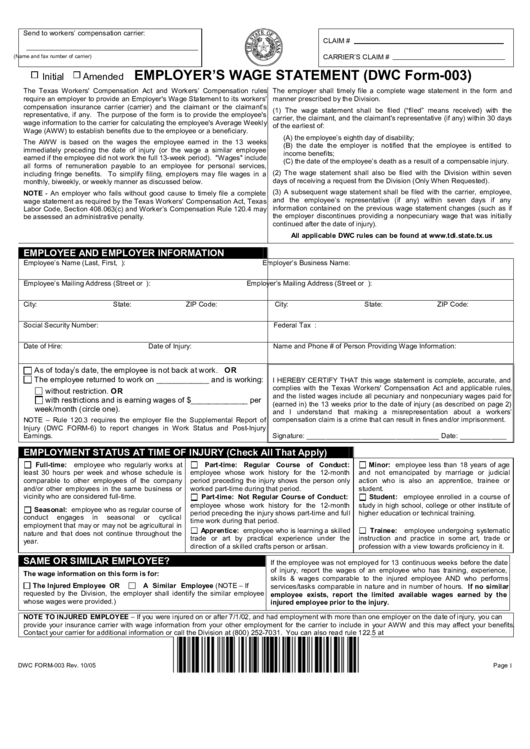

Send to workers’ compensation carrier:

CLAIM #

(Name and fax number of carrier)

CARRIER’S CLAIM #

EMPLOYER’S WAGE STATEMENT (DWC Form-003)

Initial

Amended

The Texas Workers' Compensation Act and Workers’ Compensation rules

The employer shall timely file a complete wage statement in the form and

require an employer to provide an Employer's Wage Statement to its workers'

manner prescribed by the Division.

compensation insurance carrier (carrier) and the claimant or the claimant’s

(1) The wage statement shall be filed (“filed” means received) with the

representative, if any. The purpose of the form is to provide the employee's

carrier, the claimant, and the claimant's representative (if any) within 30 days

wage information to the carrier for calculating the employee's Average Weekly

of the earliest of:

Wage (AWW) to establish benefits due to the employee or a beneficiary.

(A) the employee’s eighth day of disability;

The AWW is based on the wages the employee earned in the 13 weeks

(B) the date the employer is notified that the employee is entitled to

immediately preceding the date of injury (or the wage a similar employee

income benefits;

earned if the employee did not work the full 13-week period). "Wages" include

(C) the date of the employee’s death as a result of a compensable injury.

all forms of remuneration payable to an employee for personal services,

(2) The wage statement shall also be filed with the Division within seven

including fringe benefits. To simplify filing, employers may file wages in a

days of receiving a request from the Division (Only When Requested).

monthly, biweekly, or weekly manner as discussed below.

(3) A subsequent wage statement shall be filed with the carrier, employee,

NOTE - An employer who fails without good cause to timely file a complete

and the employee’s representative (if any) within seven days if any

wage statement as required by the Texas Workers' Compensation Act, Texas

information contained on the previous wage statement changes (such as if

Labor Code, Section 408.063(c) and Worker’s Compensation Rule 120.4 may

the employer discontinues providing a nonpecuniary wage that was initially

be assessed an administrative penalty.

continued after the date of injury).

All applicable DWC rules can be found at

EMPLOYEE AND EMPLOYER INFORMATION

Employee’s Name (Last, First, M.I.):

Employer’s Business Name:

Employee’s Mailing Address (Street or P.O. Box):

Employer’s Mailing Address (Street or P.O. Box):

City:

State:

ZIP Code:

City:

State:

ZIP Code:

Social Security Number:

Federal Tax I.D. Number:

Date of Hire:

Date of Injury:

Name and Phone # of Person Providing Wage Information:

As of today’s date, the employee is not back at work. OR

The employee returned to work on ____________ and is working:

I HEREBY CERTIFY THAT this wage statement is complete, accurate, and

complies with the Texas Workers' Compensation Act and applicable rules,

without restriction. OR

and the listed wages include all pecuniary and nonpecuniary wages paid for

with restrictions and is earning wages of $_____________ per

(earned in) the 13 weeks prior to the date of injury (as described on page 2)

week/month (circle one).

and I understand that making a misrepresentation about a workers’

NOTE – Rule 120.3 requires the employer file the Supplemental Report of

compensation claim is a crime that can result in fines and/or imprisonment.

Injury (DWC FORM-6) to report changes in Work Status and Post-Injury

Earnings.

Signature: __________________________________ Date: ____________

EMPLOYMENT STATUS AT TIME OF INJURY (Check All That Apply)

Full-time: employee who regularly works at

Part-time: Regular Course of Conduct:

Minor: employee less than 18 years of age

least 30 hours per week and whose schedule is

employee whose work history for the 12-month

and not emancipated by marriage or judicial

comparable to other employees of the company

period preceding the injury shows the person only

action who is also an apprentice, trainee or

and/or other employees in the same business or

worked part-time during that period.

student.

vicinity who are considered full-time.

Part-time: Not Regular Course of Conduct:

Student: employee enrolled in a course of

employee whose work history for the 12-month

study in high school, college or other institute of

Seasonal: employee who as regular course of

period preceding the injury shows part-time and full

higher education or technical training.

conduct

engages

in

seasonal

or

cyclical

time work during that period.

employment that may or may not be agricultural in

Apprentice: employee who is learning a skilled

Trainee: employee undergoing systematic

nature and that does not continue throughout the

trade or art by practical experience under the

instruction and practice in some art, trade or

year.

direction of a skilled crafts person or artisan.

profession with a view towards proficiency in it.

SAME OR SIMILAR EMPLOYEE?

If the employee was not employed for 13 continuous weeks before the date

of injury, report the wages of an employee who has training, experience,

The wage information on this form is for:

skills & wages comparable to the injured employee AND who performs

The Injured Employee OR

A Similar Employee (NOTE – If

services/tasks comparable in nature and in number of hours. If no similar

requested by the Division, the employer shall identify the similar employee

employee exists, report the limited available wages earned by the

whose wages were provided.)

injured employee prior to the injury.

NOTE TO INJURED EMPLOYEE – If you were injured on or after 7/1/02, and had employment with more than one employer on the date of injury, you can

provide your insurance carrier with wage information from your other employment for the carrier to include in your AWW and this may affect your benefits.

Contact your carrier for additional information or call the Division at (800) 252-7031. You can also read rule 122.5 at /wc/rules/.

DWC FORM-003 Rev. 10/05

Page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2