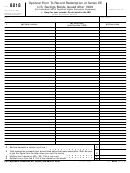

4

Form 8815 (2015)

Page

Line 9

Follow these steps before you fill in the Line 9 Worksheet below.

Line 9 Worksheet (keep a copy for your records)

Step

Action

1. Enter the amount from line 2 of Schedule B (Form

If you received social security benefits, use Pub. 915 to figure the

1

1040A or 1040)

.

.

.

.

.

.

.

.

.

1.

taxable amount of your benefits.

2. Form 1040 filers, add the amounts on lines 7, 9a, 10

2

If you are claiming both the premium tax credit (PTC) and

through 14, 15b, 16b, 17 through 19, 20b, and 21.

self-employed health insurance deduction, see Self-Employed

Enter the total. Form 1040A filers, add the amounts on

Health Insurance Deduction and PTC in Pub. 974, Premium Tax

lines 7, 9a, 10, 11b, 12b, 13, and 14b. Enter the total

2.

Credit, and complete the appropriate worksheets.

3. Add lines 1 and 2

.

.

.

.

.

.

.

.

3.

3

If you made contributions to a traditional IRA for 2015 and you

4. Form 1040 filers, enter the total of the amounts from

were covered by a retirement plan at work or through self-

lines 23 through 32, plus any amount entered on the

employment, use Pub. 590-A to figure your IRA deduction.

dotted line next to line 36. Form 1040A filers, enter

the amount from lines 16 and 17 .

.

.

.

.

4.

If you file Form 1040, figure any amount to be entered on the

4

5. Subtract line 4 from line 3. Enter the result here and on

dotted line next to line 36.

Form 8815, line 9 .

.

.

.

.

.

.

.

.

5.

5

Complete the following lines on your return if they apply.

IF you file Form...

THEN complete lines...

1040

8b, 9a–21, 23*–32

1040A

8b, 9a–14b, 16*, and 17

If any of the following apply, see Pub. 550:

6

• You are filing Form 2555 or 2555-EZ (relating to foreign earned

income), or Form 4563 (exclusion of income for residents of

American Samoa),

• You have employer-provided adoption benefits for 2015,

• You are excluding income from Puerto Rico, or

• You have investment interest expense attributable to royalty

income.

*

For purposes of figuring the amount to put on Form 8815, line 9, do not reduce

your educator expenses, if any, by the amount on Form 8815, line 14.

1

1 2

2 3

3 4

4