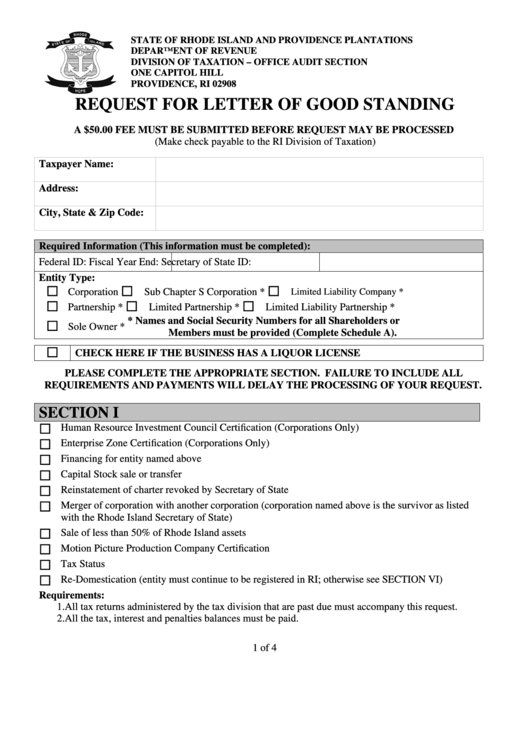

STATE OF RHODE ISLAND AND PROVIDENCE PLANTATIONS

DEPARTMENT OF REVENUE

DIVISION OF TAXATION – OFFICE AUDIT SECTION

ONE CAPITOL HILL

PROVIDENCE, RI 02908

REQUEST FOR LETTER OF GOOD STANDING

A $50.00 FEE MUST BE SUBMITTED BEFORE REQUEST MAY BE PROCESSED

(Make check payable to the RI Division of Taxation)

Taxpayer Name:

Address:

City, State & Zip Code:

Required Information (This information must be completed):

Federal ID:

Fiscal Year End:

Secretary of State ID:

Entity Type:

Corporation

Sub Chapter S Corporation *

Limited Liability Company *

Partnership *

Limited Partnership *

Limited Liability Partnership *

* Names and Social Security Numbers for all Shareholders or

Sole Owner *

Members must be provided (Complete Schedule A).

CHECK HERE IF THE BUSINESS HAS A LIQUOR LICENSE

PLEASE COMPLETE THE APPROPRIATE SECTION. FAILURE TO INCLUDE ALL

REQUIREMENTS AND PAYMENTS WILL DELAY THE PROCESSING OF YOUR REQUEST.

SECTION I

Human Resource Investment Council Certification (Corporations Only)

Enterprise Zone Certification (Corporations Only)

Financing for entity named above

Capital Stock sale or transfer

Reinstatement of charter revoked by Secretary of State

Merger of corporation with another corporation (corporation named above is the survivor as listed

with the Rhode Island Secretary of State)

Sale of less than 50% of Rhode Island assets

Motion Picture Production Company Certification

Tax Status

Re-Domestication (entity must continue to be registered in RI; otherwise see SECTION VI)

Requirements:

1. All tax returns administered by the tax division that are past due must accompany this request.

2. All the tax, interest and penalties balances must be paid.

1 of 4

1

1 2

2 3

3 4

4 5

5