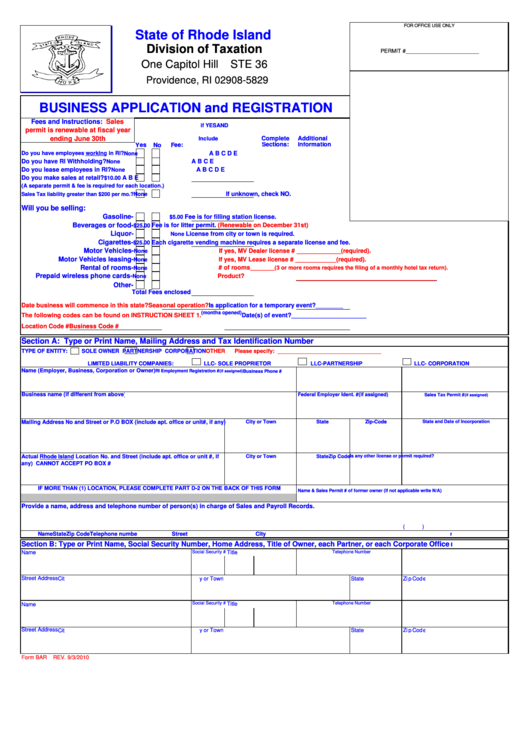

Form Bar - Business Application And Registration

ADVERTISEMENT

FOR OFFICE USE ONLY

State of Rhode Island

Division of Taxation

PERMIT #________________________

One Capitol Hill

STE 36

Providence, RI 02908-5829

BUSINESS APPLICATION and REGISTRATION

Fees and Instructions:

Sales

if YES

AND

permit is renewable at fiscal year

Complete

Additional

ending June 30th

Include

Sections:

Information

Yes

No

Fee:

Do you have employees working in RI?

A B C D E

None

Do you have RI Withholding?

A B C E

None

Do you lease employees in RI?

A B C D E

None

Do you make sales at retail?

A B E

$10.00

(A separate permit & fee is required for each location.)

If unknown, check NO.

None

Sales Tax liability greater than $200 per mo.?

Will you be selling:

Gasoline-

Fee is for filling station license.

$5.00

Beverages or food-

Fee is for litter permit.

(Renewable on December 31st)

$25.00

Liquor-

License from city or town is required.

None

Cigarettes-

Each cigarette vending machine requires a separate license and fee.

$25.00

Motor Vehicles-

If yes, MV Dealer license # _____________(required).

None

Motor Vehicles leasing-

If yes, MV Lease license # ____________(required).

None

Rental of rooms-

# of rooms

________(3 or more rooms requires the filing of a monthly hotel tax return).

None

Prepaid wireless phone cards-

Product?

None

Other-

Total Fees enclosed

Date business will commence in this state?

Seasonal operation?

Is application for a temporary event?________

(months opened)

The following codes can be found on INSTRUCTION SHEET 1.

Date(s) of event?______________________

Location Code #

Business Code #

Section A: Type or Print Name, Mailing Address and Tax Identification Number

TYPE OF ENTITY:

SOLE OWNER

PARTNERSHIP

CORPORATION

OTHER

Please specify: __________________________________

LIMITED LIABILITY COMPANIES:

LLC- SOLE PROPRIETOR

LLC-PARTNERSHIP

LLC- CORPORATION

Name (Employer, Business, Corporation or Owner)

RI Employment Registration #

(if assigned)

Business Phone #

Business name (if different from above)

Federal Employer Ident. #(if assigned)

Sales Tax Permit #

(if assigned)

State and Date of Incorporation

Mailing Address No and Street or P.O BOX (include apt. office or unit#, if any)

City or Town

State

Zip-Code

Is any other license or permit required?

Actual Rhode Island Location No. and Street (include apt. office or unit #, if

City or Town

State

Zip Code

any) CANNOT ACCEPT PO BOX #

IF MORE THAN (1) LOCATION, PLEASE COMPLETE PART D-2 ON THE BACK OF THIS FORM

Name & Sales Permit # of former owner (if not applicable write N/A)

Provide a name, address and telephone number of person(s) in charge of Sales and Payroll Records.

(

)

Name

Street

City

State

Zip Code

Telephone number

Section B: Type or Print Name, Social Security Number, Home Address, Title of Owner, each Partner, or each Corporate Officer

Social Security #

Telephone Number

Name

Title

Street Address

City or Town

State

Zip Code

Social Security #

Title

Telephone Number

Name

Street Address

City or Town

State

Zip Code

Form BAR

REV. 9/3/2010

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8