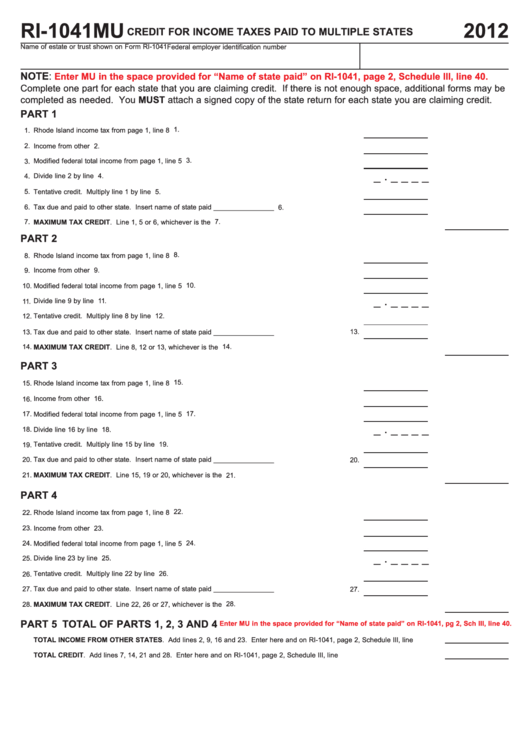

RI-1041MU

2012

CREDIT FOR INCOME TAXES PAID TO MULTIPLE STATES

Name of estate or trust shown on Form RI-1041

Federal employer identification number

NOTE:

Enter MU in the space provided for “Name of state paid” on RI-1041, page 2, Schedule III, line 40.

Complete one part for each state that you are claiming credit. If there is not enough space, additional forms may be

completed as needed. You MUST attach a signed copy of the state return for each state you are claiming credit.

PART 1

1.

1.

Rhode Island income tax from page 1, line 8 .............................................................................................

2.

Income from other state................................................................................................................................ 2.

Modified federal total income from page 1, line 5 ....................................................................................... 3.

3.

_ . _ _ _ _

Divide line 2 by line 3................................................................................................................................... 4.

4.

Tentative credit. Multiply line 1 by line 4..................................................................................................... 5.

5.

6.

Tax due and paid to other state. Insert name of state paid ________________ ....................................... 6.

MAXIMUM TAX CREDIT. Line 1, 5 or 6, whichever is the smallest...................................................................................................... 7.

7.

PART 2

8.

8.

Rhode Island income tax from page 1, line 8 .............................................................................................

9.

Income from other state................................................................................................................................ 9.

Modified federal total income from page 1, line 5 ....................................................................................... 10.

10.

_ . _ _ _ _

11.

Divide line 9 by line 10................................................................................................................................. 11.

12.

Tentative credit. Multiply line 8 by line 11.................................................................................................... 12.

13.

Tax due and paid to other state. Insert name of state paid ________________ .......................................

13.

MAXIMUM TAX CREDIT. Line 8, 12 or 13, whichever is the smallest.................................................................................................. 14.

14.

PART 3

Rhode Island income tax from page 1, line 8 ............................................................................................. 15.

15.

Income from other state................................................................................................................................ 16.

16.

Modified federal total income from page 1, line 5 ....................................................................................... 17.

17.

_ . _ _ _ _

18.

Divide line 16 by line 17............................................................................................................................... 18.

19.

Tentative credit. Multiply line 15 by line 18................................................................................................. 19.

20.

Tax due and paid to other state. Insert name of state paid ________________ .......................................

20.

21.

MAXIMUM TAX CREDIT. Line 15, 19 or 20, whichever is the smallest................................................................................................ 21.

PART 4

Rhode Island income tax from page 1, line 8 ............................................................................................. 22.

22.

Income from other state................................................................................................................................ 23.

23.

Modified federal total income from page 1, line 5 ....................................................................................... 24.

24.

_ . _ _ _ _

25.

Divide line 23 by line 24............................................................................................................................... 25.

26.

Tentative credit. Multiply line 22 by line 25................................................................................................. 26.

Tax due and paid to other state. Insert name of state paid ________________ .......................................

27.

27.

MAXIMUM TAX CREDIT. Line 22, 26 or 27, whichever is the smallest................................................................................................ 28.

28.

TOTAL OF PARTS 1, 2, 3 AND 4

PART 5

Enter MU in the space provided for “Name of state paid” on RI-1041, pg 2, Sch III, line 40.

29.

TOTAL INCOME FROM OTHER STATES. Add lines 2, 9, 16 and 23. Enter here and on RI-1041, page 2, Schedule III, line 36..... 29.

30.

TOTAL CREDIT. Add lines 7, 14, 21 and 28. Enter here and on RI-1041, page 2, Schedule III, line 40............................................ 30.

1

1