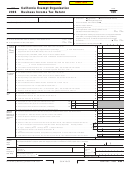

Form 109 - California Exempt Organization Business Income Tax Return - 2015 Page 2

ADVERTISEMENT

26 Refund. If line 25 is less than line 24, then subtract line 25 from line 24. . . . . . . . . . . . . . . . . . . . . . . . . . . .

26

00

a Fill in the account information to have the refund directly deposited. Routing number. . .

. . . . . .

26a

b Type: Checking

Savings

c Account Number . . . . . . . . . . . . . . . . . . . . . . .

. . . . . .

26c

Refund or

Amount

27 Penalties and interest. See General Information M. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

. . . . . . . . . . .

27

00

Due

28

Check if estimate penalty computed using Exception B or C and attach form FTB 5806

. . . . . . . . . . . . .

29 Total amount due. Add line 22, line 23, line 25, and line 27, then subtract line 24. . . . . . . . . .

. . . . . . . . . . .

29

00

Unrelated Business Taxable Income

Part I Unrelated Trade or Business Income

00

1 a Gross receipts or gross sales______________ b Less returns and allowances______________ c Balance

1c

00

2 Cost of goods sold and/or operations (Schedule A, line 7) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

. . . . . . . . . .

2

00

3 Gross profit. Subtract line 2 from line 1c . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

00

4 a Capital gain net income. See Specific Line Instructions – Trusts attach Schedule D (541) . . . . . . . . . . . . . . . . . . . . .

4a

b Net gain (loss) from Part II, Schedule D-1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4b

00

00

c Capital loss deduction for trusts . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4c

5 Income (or loss) from partnerships, limited liability companies, or S corporations. See specific line instructions.

Attach Schedule K-1 (565, 568, or 100S) or similar schedule . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

00

00

6 Rental income (Schedule C) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

00

7 Unrelated debt-financed income (Schedule D) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

00

8 Investment income of an R&TC Section 23701g, 23701i, or 23701n organization (Schedule E) . . . . . . . . . . . . . . . . . . .

8

00

9 Interest, Annuities, Royalties and Rents from controlled organizations (Schedule F) . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

00

10 Exploited exempt activity income (Schedule G) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10

00

11 Advertising income (Schedule H, Part III, Column A) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11

00

12 Other income. Attach schedule . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12

00

13 Total unrelated trade or business income. Add line 3 through line 12 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13

Part II Deductions Not Taken Elsewhere (Except for contributions, deductions must be directly connected with the unrelated business income.)

14 Compensation of officers, directors, and trustees from Schedule I . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14

00

00

15 Salaries and wages . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

15

00

16 Repairs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

16

17 Bad debts . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17

00

00

18 Interest. Attach schedule . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

18

00

19 Taxes. Attach schedule . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

19

00

20 Contributions. See instructions and attach schedule . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

20

00

21 a Depreciation

21a

(Corporations and Associations – Schedule J) (Trusts – form FTB 3885F)

00

b Less: depreciation claimed on Schedule A. See instructions . . . . . . . . . . . . . . .

21b

21

00

00

22 Depletion. Attach schedule. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

22

23 a Contributions to deferred compensation plans . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 23a

00

00

b Employee benefit programs. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 23b

00

24 Other deductions. Attach schedule. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

24

25 Total deductions. Add line 14 through line 24 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 25

00

00

26 Unrelated business taxable income before allowable excess advertising costs. Subtract line 25 from line 13 . . . . . . . . .

26

00

27 Excess advertising costs (Schedule H, Part III, Column B) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

27

00

28 Unrelated business taxable income before specific deduction. Subtract line 27 from line 26 . . . . . . . . . . . . . . . . . . . . .

28

00

29 Specific deduction. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

29

00

30 Unrelated business taxable income. Subtract line 29 from line 28. If line 28 is a loss, enter line 28.. . . . . . . . . . . . . . . . . . 30

To learn about your privacy rights, how we may use your information, and the consequences for not providing the requested information, go to ftb.ca.gov and

search for privacy notice. To request this notice by mail, call 800.852.5711.

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and

Sign

belief, it is true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Here

Title

Date

Telephone

Signature

of officer

(

)

Date

PTIN

Check if self-

Preparer’s

employed

signature

Paid

FEIN

-

Preparer’s

Firm’s name (or yours,

Use Only

if self-employed)

Telephone

and address

(

)

Yes No

May the FTB discuss this return with the preparer shown above? See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Side 2 Form 109

2015

C1

3642153

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5