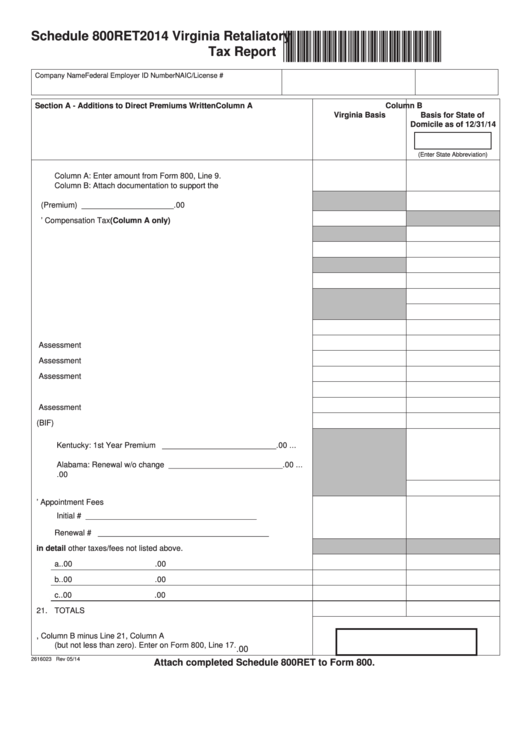

Schedule 800RET

2014 Virginia Retaliatory

*VA8RET114888*

Tax Report

Company Name

Federal Employer ID Number

NAIC/License #

Section A - Additions to Direct Premiums Written

Column A

Column B

Virginia Basis

Basis for State of

Domicile as of 12/31/14

(Enter State Abbreviation)

1. Insurance Premiums License Tax

Column A: Enter amount from Form 800, Line 9.

Column B: Attach documentation to support the computation...................

.00

.00

2. Annuity or Fire Marshall Tax (Premium) _____________________ .00 ...

.00

3. Workers’ Compensation Tax (Column A only) .........................................

.00

4. Company License or Certificate of Authority Fee ......................................

.00

5. Annual Corporation Registration Fee ........................................................

.00

.00

6. Annual Statement Filing/Abstract/Publication Fee ....................................

.00

7. Fee for Safekeeping Deposit .....................................................................

.00

.00

8. Corporation Permit Tax ..............................................................................

.00

9. Capital Stock Tax .......................................................................................

.00

10. Assessment for Maintenance of Bureau of Insurance ...............................

.00

.00

11. Fire Programs Fund Assessment ..............................................................

.00

.00

12. Flood Fund Assessment ............................................................................

.00

.00

13. HEAT Fund Assessment ............................................................................

.00

.00

14. Fraud Fund Assessment............................................................................

.00

.00

15. MCHIP Fund Assessment .........................................................................

.00

.00

16. Birth-Related Neurological Injury Fund Assessment (BIF) ........................

.00

.00

17. Municipal Average Gross Premium Tax

Kentucky: 1st Year Premium

__________________________.00 ...

Alabama: Renewal w/o change __________________________.00 ...

.00

18. Municipal Average Fixed Fees ..................................................................

.00

19. Agents’ Appointment Fees

Initial #

_______________________________________

Renewal #

_______________________________________ ........

.00

.00

20. Specify in detail other taxes/fees not listed above. ..................................

a.

.00

.00

b.

.00

.00

c.

.00

.00

21. TOTALS .....................................................................................................

.00

.00

22. RETALIATORY TAX DUE - Line 21, Column B minus Line 21, Column A

(but not less than zero). Enter on Form 800, Line 17. ...............................

.00

2616023 Rev 05/14

Attach completed Schedule 800RET to Form 800.

1

1