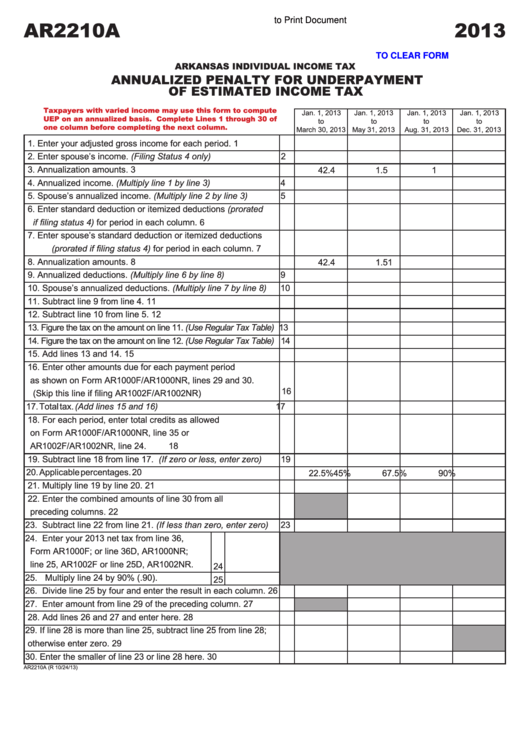

Click Here to Print Document

AR2210A

2013

CLICK HERE TO CLEAR FORM

ARKANSAS INDIVIDUAL INCOME TAX

ANNUALIZED PENALTY FOR UNDERPAYMENT

OF ESTIMATED INCOME TAX

Taxpayers with varied income may use this form to compute

Jan. 1, 2013

Jan. 1, 2013

Jan. 1, 2013

Jan. 1, 2013

UEP on an annualized basis. Complete Lines 1 through 30 of

to

to

to

to

one column before completing the next column.

March 30, 2013

May 31, 2013

Aug. 31, 2013

Dec. 31, 2013

1. Enter your adjusted gross income for each period.

1

2. Enter spouse’s income. (Filing Status 4 only)

2

3. Annualization amounts.

3

4

2.4

1.5

1

4. Annualized income. (Multiply line 1 by line 3)

4

5. Spouse’s annualized income. (Multiply line 2 by line 3)

5

6. Enter standard deduction or itemized deductions (prorated

if filing status 4) for period in each column.

6

7. Enter spouse’s standard deduction or itemized deductions

(prorated if filing status 4) for period in each column.

7

8. Annualization amounts.

8

4

2.4

1.5

1

9. Annualized deductions. (Multiply line 6 by line 8)

9

10. Spouse’s annualized deductions. (Multiply line 7 by line 8)

10

11. Subtract line 9 from line 4.

11

12. Subtract line 10 from line 5.

12

13. Figure the tax on the amount on line 11. (Use Regular Tax Table) 13

14. Figure the tax on the amount on line 12. (Use Regular Tax Table) 14

15. Add lines 13 and 14.

15

16. Enter other amounts due for each payment period

as shown on Form AR1000F/AR1000NR, lines 29 and 30.

16

(Skip this line if filing AR1002F/AR1002NR)

17. Total tax. (Add lines 15 and 16)

17

18. For each period, enter total credits as allowed

on Form AR1000F/AR1000NR, line 35 or

AR1002F/AR1002NR, line 24.

18

19. Subtract line 18 from line 17. (If zero or less, enter zero)

19

20. Applicable percentages.

20

22.5%

45%

67.5%

90%

21. Multiply line 19 by line 20.

21

22. Enter the combined amounts of line 30 from all

preceding columns.

22

23. Subtract line 22 from line 21. (If less than zero, enter zero)

23

24. Enter your 2013 net tax from line 36,

Form AR1000F; or line 36D, AR1000NR;

line 25, AR1002F or line 25D, AR1002NR.

24

25. Multiply line 24 by 90% (.90).

25

26. Divide line 25 by four and enter the result in each column.

26

27. Enter amount from line 29 of the preceding column.

27

28. Add lines 26 and 27 and enter here.

28

29. If line 28 is more than line 25, subtract line 25 from line 28;

otherwise enter zero.

29

30. Enter the smaller of line 23 or line 28 here.

30

AR2210A (R 10/24/13)

1

1 2

2