FORM 760-PFF

2015 PAYMENT COUPON FOR FARMERS,

FISHERMEN AND MERCHANT SEAMEN

If you file your return electronically, pay your tax online through e-File, It is the fastest, most efficient way to

pay the tax due. Visit the Department’s website at for additional information.

TO BE SURE THAT YOUR PAYMENT IS APPLIED CORRECTLY,

FOLLOW THESE INSTRUCTIONS:

If you filed a 2015 Form 760, Form 760PY or Form 763 and owe tax, but did not send in your payment with

the return, use this form to send in your payment on or before the due date. .

• If the return was filed electronically through e-File or mailed directly to the Department, make your

check payable to the Department of Taxation and mail the payment with the voucher below to:

Virginia Department of Taxation

P. O. Box 1478

Richmond, VA 23218-1478

• If the return was filed with the Commissioner of the Revenue for your locality, make your check payable

to your local Treasurer and mail the payment to your locality so that the payment will be credited to

your account at the local office.

Please do not send a paper copy of your return with your payment. If a paper copy of the return is sent, the

payment will not be properly posted to the account.

COMPLETE THE PAYMENT COUPON BY

INCLUDING THE FOLLOWING INFORMATION:

Social Security Number and Spouse’s Social Security Number (if filing a joint return). This must match the

information on your return.

Your name and spouse’s name (if filing a joint return), address, and phone number.

The amount of the enclosed payment.

Make sure that your Social Security Number is written on the check.

Due Date: Please note that if your full payment is not postmarked by May 2, 2016, you will be sent a bill for

tax, penalty and interest.

A qualifying farmer, fisherman or merchant seaman, must make payment by March 1, 2016, to avoid

underpayment penalty.

For additional information visit: or call (804) 367-8031.

Detach Form 760-PFF here. Complete this form and mail it with your check to the address shown on the form.

760-PFF Va. Dept. of Taxation Rev. 11/15

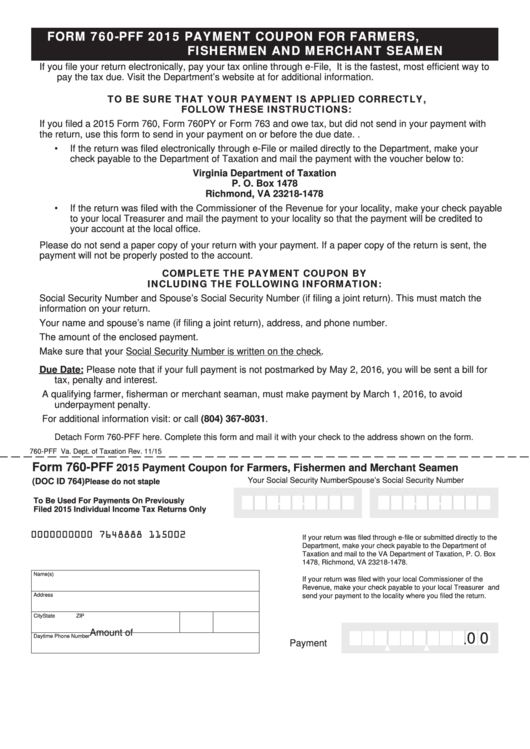

Form 760-PFF

2015 Payment Coupon for Farmers, Fishermen and Merchant Seamen

Your Social Security Number

Spouse’s Social Security Number

(DOC ID 764)

Please do not staple

To Be Used For Payments On Previously

Filed 2015 Individual Income Tax Returns Only

0000000000 7648888 115002

If your return was filed through e-file or submitted directly to the

Department, make your check payable to the Department of

Taxation and mail to the VA Department of Taxation, P. O. Box

1478, Richmond, VA 23218-1478.

Name(s)

If your return was filed with your local Commissioner of the

Revenue, make your check payable to your local Treasurer and

Address

send your payment to the locality where you filed the return.

City

State

ZIP

Amount of

0 0

Daytime Phone Number

.

Payment

1

1