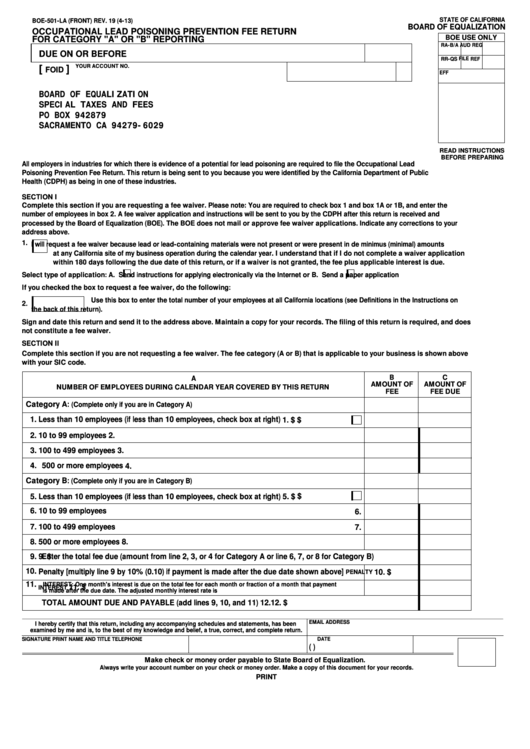

STATE OF CALIFORNIA

BOE-501-LA (FRONT) REV. 19 (4-13)

BOARD OF EQUALIZATION

OCCUPATIONAL LEAD POISONING PREVENTION FEE RETURN

BOE USE ONLY

FOR CATEGORY "A" OR "B" REPORTING

RA-B/A

AUD

REG

DUE ON OR BEFORE

RR-QS

FILE

REF

YOUR ACCOUNT NO.

[

]

FOID

EFF

BOARD OF EQUALIZATION

SPECIAL TAXES AND FEES

PO BOX 942879

SACRAMENTO CA 94279-6029

READ INSTRUCTIONS

BEFORE PREPARING

All employers in industries for which there is evidence of a potential for lead poisoning are required to file the Occupational Lead

Poisoning Prevention Fee Return. This return is being sent to you because you were identified by the California Department of Public

Health (CDPH) as being in one of these industries.

SECTION I

Complete this section if you are requesting a fee waiver. Please note: You are required to check box 1 and box 1A or 1B, and enter the

number of employees in box 2. A fee waiver application and instructions will be sent to you by the CDPH after this return is received and

processed by the Board of Equalization (BOE). The BOE does not mail or approve fee waiver applications. Indicate any corrections to your

address above.

1.

I will request a fee waiver because lead or lead-containing materials were not present or were present in de minimus (minimal) amounts

at any California site of my business operation during the calendar year. I understand that if I do not complete a waiver application

within 180 days following the due date of this return, or if a waiver is not granted, the fee plus applicable interest is due.

Select type of application: A.

Send instructions for applying electronically via the Internet or B.

Send a paper application

If you checked the box to request a fee waiver, do the following:

Use this box to enter the total number of your employees at all California locations (see Definitions in the Instructions on

2.

the back of this return).

Sign and date this return and send it to the address above. Maintain a copy for your records. The filing of this return is required, and does

not constitute a fee waiver.

SECTION II

Complete this section if you are not requesting a fee waiver. The fee category (A or B) that is applicable to your business is shown above

with your SIC code.

B

C

A

AMOUNT OF

AMOUNT OF

NUMBER OF EMPLOYEES DURING CALENDAR YEAR COVERED BY THIS RETURN

FEE

FEE DUE

Category A:

(Complete only if you are in Category A)

1. Less than 10 employees (if less than 10 employees, check box at right)

1.

$

$

2. 10 to 99 employees

2.

3. 100 to 499 employees

3.

4.

500 or more employees

4.

Category B:

(Complete only if you are in Category B)

$

5. Less than 10 employees (if less than 10 employees, check box at right)

5.

$

6. 10 to 99 employees

6.

7. 100 to 499 employees

7.

8. 500 or more employees

8.

9.

Enter the total fee due (amount from line 2, 3, or 4 for Category A or line 6, 7, or 8 for Category B)

9. $

10. Penalty [multiply line 9 by 10% (0.10) if payment is made after the due date shown above]

10. $

PENALTY

11.

INTEREST: One month's interest is due on the total fee for each month or fraction of a month that payment

11. $

INTEREST

is made after the due date. The adjusted monthly interest rate is

12.

TOTAL AMOUNT DUE AND PAYABLE (add lines 9, 10, and 11)

12.

$

EMAIL ADDRESS

I hereby certify that this return, including any accompanying schedules and statements, has been

examined by me and is, to the best of my knowledge and belief, a true, correct, and complete return.

SIGNATURE

PRINT NAME AND TITLE

TELEPHONE

DATE

(

)

Make check or money order payable to State Board of Equalization.

Always write your account number on your check or money order. Make a copy of this document for your records.

CLEAR

PRINT

1

1 2

2