Print Blank Form

Print

Clear

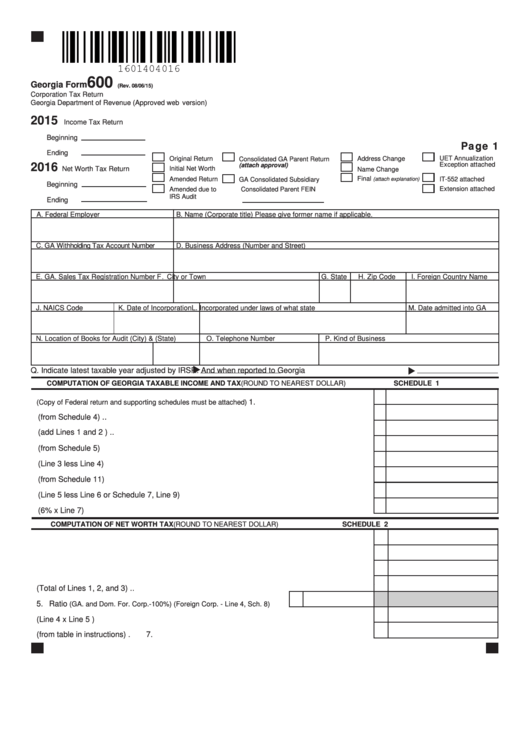

600

Georgia Form

(Rev. 08/06/15)

Corporation Tax Return

Georgia Department of Revenue (Approved web version)

2015

Income Tax Return

Beginning

Page 1

Ending

Original Return

Address Change

UET Annualization

Consolidated GA Parent Return

2016

Exception attached

(attach approval)

Net Worth Tax Return

Initial Net Worth

Name Change

Final

Amended Return

GA Consolidated Subsidiary

IT-552 attached

(attach explanation)

Beginning

Extension attached

Amended due to

Consolidated Parent FEIN

IRS Audit

Ending

A. Federal Employer I.D. Number

B. Name (Corporate title) Please give former name if applicable.

C. GA Withholding Tax Account Number

D. Business Address (Number and Street)

E. GA. Sales Tax Registration Number

F. City or Town

G. State

H. Zip Code

I. Foreign Country Name

J. NAICS Code

K. Date of Incorporation

L. Incorporated under laws of what state

M. Date admitted into GA

N. Location of Books for Audit (City) & (State)

O. Telephone Number

P. Kind of Business

Q. Indicate latest taxable year adjusted by IRS

R. And when reported to Georgia

COMPUTATION OF GEORGIA TAXABLE INCOME AND TAX

(ROUND TO NEAREST DOLLAR)

SCHEDULE 1

1. Federal Taxable Income

1.

(Copy of Federal return and supporting schedules must be attached) .....

2. Additions to Federal Income (from Schedule 4) ...................................................................

2.

3. Total (add Lines 1 and 2 ) .....................................................................................................

3.

4. Subtractions from Federal Income (from Schedule 5) .........................................................

4.

5. Balance (Line 3 less Line 4) .................................................................................................

5.

6. Georgia Net Operating loss deduction (from Schedule 11) .................................................

6.

7. Georgia Taxable Income (Line 5 less Line 6 or Schedule 7, Line 9) ...................................

7.

8. Income Tax - (6% x Line 7) ....................................................................................................

8.

COMPUTATION OF NET WORTH TAX

(ROUND TO NEAREST DOLLAR)

SCHEDULE 2

1. Total Capital stock issued ......................................................................................................

1.

2. Paid in or Capital surplus .....................................................................................................

2.

3. Total Retained earnings .......................................................................................................

3.

4. Net Worth (Total of Lines 1, 2, and 3) ....................................................................................

4.

5. Ratio

....

5.

(GA. and Dom. For. Corp.-100%) (Foreign Corp. - Line 4, Sch. 8)

6. Net Worth Taxable by Georgia (Line 4 x Line 5 ) ..................................................................

6.

7. Net Worth Tax (from table in instructions) .............................................................................

7.

1

1 2

2 3

3 4

4 5

5 6

6