Print

Clear

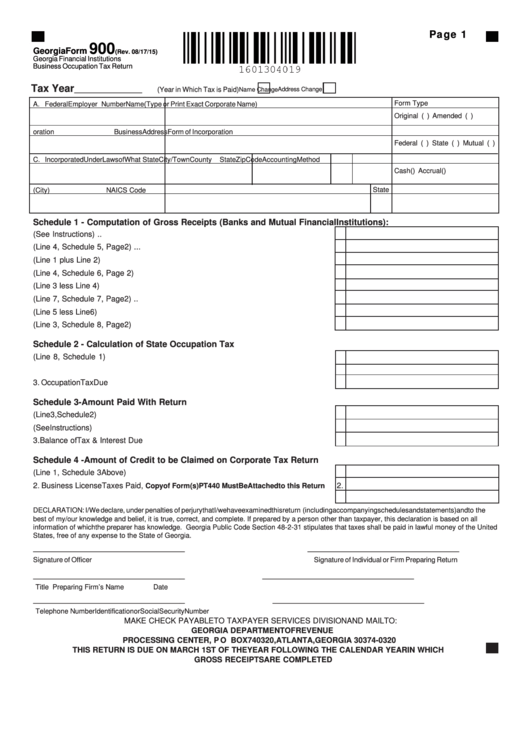

Page 1

900

Georgia Form

(Rev. 08/17/15)

Georgia Financial Institutions

Business Occupation Tax Return

Tax Year_____________

(Year in Which Tax is Paid)

Address Change

Name Change

Form Type

A. Federal Employer I.D. Number

Name

(Type or Print Exact Corporate Name)

Original ( ) Amended ( )

B. Date of Incorporation

Business Address

Form of Incorporation

Federal ( ) State ( ) Mutual ( )

C. Incorporated Under Laws of What State City/Town

County

State

Zip Code

Accounting Method

Cash ( ) Accrual ( )

State

D. Date Admitted to Georgia

Location of Books for Audit (City)

NAICS Code

Schedule 1 - Computation of Gross Receipts (Banks and Mutual Financial Institutions):

1. Gross Receipts (See Instructions) ............................................................................... 1.

2. Additions (Line 4, Schedule 5, Page 2) ....................................................................... 2.

3. Total (Line 1 plus Line 2) .............................................................................................. 3.

4. Exclusions (Line 4, Schedule 6, Page 2) ..................................................................... 4.

5. Balance (Line 3 less Line 4) ......................................................................................... 5.

6. Deductions (Line 7, Schedule 7, Page 2) .................................................................... 6.

7. Balance (Line 5 less Line 6) ......................................................................................... 7.

8. Adjusted Gross Receipts (Line 3, Schedule 8, Page 2) .............................................. 8.

Schedule 2 - Calculation of State Occupation Tax

1. Adjusted Gross Receipts (Line 8, Schedule 1) .......................................................... 1.

2. Occupation Tax Rate ................................................................................................ . . .

.

2.

x .0025

3. Occupation Tax Due ..................................................................................................... 3.

Schedule 3 - Amount Paid With Return

1. Occupation Tax (Line 3, Schedule 2) ........................................................................... 1.

2. Interest Due (See Instructions) .................................................................................... 2.

3. Balance of Tax & Interest Due with Return .................................................................. . 3.

Schedule 4 - Amount of Credit to be Claimed on Corporate Tax Return

1. Occupation Tax (Line 1, Schedule 3 Above) ................................................................ 1.

Business License Taxes Paid,

Copy of Form(s) PT440 Must Be Attached to this Return

2.

2.

3. Total Credit to be Claimed Against Corporate Income Tax .......................................... 3.

DECLARATION: I/We declare, under penalties of perjury that I/we have examined this return (including accompanying schedules and statements) and to the

best of my/our knowledge and belief, it is true, correct, and complete. If prepared by a person other than taxpayer, this declaration is based on all

information of which the preparer has knowledge. Georgia Public Code Section 48-2-31 stipulates that taxes shall be paid in lawful money of the United

States, free of any expense to the State of Georgia.

_____________________________

_____________________________

Signature of Officer

Signature of Individual or Firm Preparing Return

_____________________________

_____________________________

Title

Date

Preparing Firm’s Name

_____________________________

_____________________________

Telephone Number

Identification or Social Security Number

MAKE CHECK PAYABLE TO TAXPAYER SERVICES DIVISION AND MAIL TO:

GEORGIA DEPARTMENT OF REVENUE

PROCESSING CENTER, P O BOX 740320, ATLANTA, GEORGIA 30374-0320

THIS RETURN IS DUE ON MARCH 1ST OF THE YEAR FOLLOWING THE CALENDAR YEAR IN WHICH

GROSS RECEIPTS ARE COMPLETED

1

1 2

2 3

3 4

4