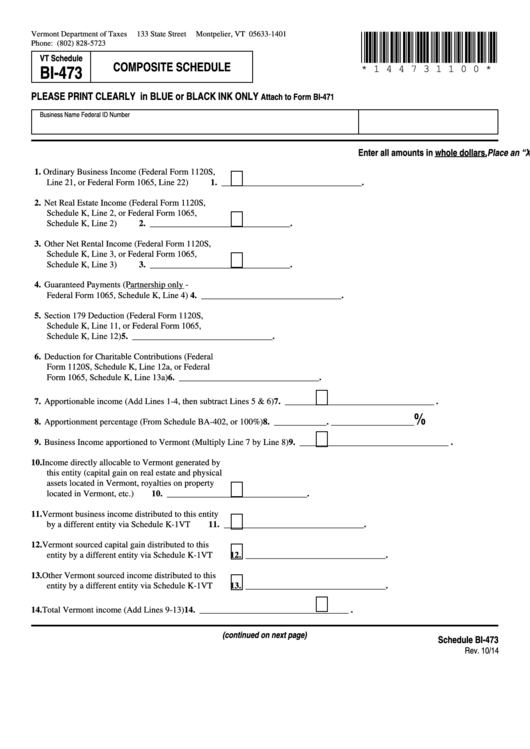

Schedule Bi-473 - Vermont Composite Schedule

ADVERTISEMENT

Vermont Department of Taxes

133 State Street

Montpelier, VT 05633-1401

*144731100*

Phone: (802) 828-5723

VT Schedule

COMPOSITE SCHEDULE

BI-473

* 1 4 4 7 3 1 1 0 0 *

PLEASE PRINT CLEARLY in BLUE or BLACK INK ONLY

Attach to Form BI-471

Business Name

Federal ID Number

Place an “X” in the box left of the line number to indicate a loss amount.

Enter all amounts in whole dollars.

1. Ordinary Business Income (Federal Form 1120S,

Line 21, or Federal Form 1065, Line 22) . . . . . . . . .

1. ________________________________ .

2. Net Real Estate Income (Federal Form 1120S,

Schedule K, Line 2, or Federal Form 1065,

Schedule K, Line 2) . . . . . . . . . . . . . . . . . . . . . . . . . .

2. ________________________________ .

3. Other Net Rental Income (Federal Form 1120S,

Schedule K, Line 3, or Federal Form 1065,

Schedule K, Line 3) . . . . . . . . . . . . . . . . . . . . . . . . . .

3. ________________________________ .

4. Guaranteed Payments (Partnership only -

Federal Form 1065, Schedule K, Line 4) . . . . . . . . . . . . . . 4. ________________________________ .

5. Section 179 Deduction (Federal Form 1120S,

Schedule K, Line 11, or Federal Form 1065,

Schedule K, Line 12) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .5. ________________________________ .

6. Deduction for Charitable Contributions (Federal

Form 1120S, Schedule K, Line 12a, or Federal

Form 1065, Schedule K, Line 13a) . . . . . . . . . . . . . . . . . . . 6. ________________________________ .

7. Apportionable income (Add Lines 1-4, then subtract Lines 5 & 6) . . . . . . . .

7. __________________________________ .

%

8. Apportionment percentage (From Schedule BA-402, or 100%) . . . . . . . . . . . . . . . . .8. ____________ . ___________________

9. Business Income apportioned to Vermont (Multiply Line 7 by Line 8) . . . . .

9. __________________________________ .

10. Income directly allocable to Vermont generated by

this entity (capital gain on real estate and physical

assets located in Vermont, royalties on property

located in Vermont, etc .) . . . . . . . . . . . . . . . . . . . . . .

10. ________________________________ .

11. Vermont business income distributed to this entity

by a different entity via Schedule K-1VT . . . . . . . . .

11. ________________________________ .

12. Vermont sourced capital gain distributed to this

entity by a different entity via Schedule K-1VT . . . .

12. ________________________________ .

13. Other Vermont sourced income distributed to this

entity by a different entity via Schedule K-1VT . . . .

13. ________________________________ .

14. Total Vermont income (Add Lines 9-13) . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14. __________________________________ .

(continued on next page)

Schedule BI-473

Rev. 10/14

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2