EXTENSION REQUEST INSTRUCTIONS

EXTENSION REQUEST:

To be used by a corporation for requesting an additional one (1) month extension of time for filing a

Rhode Island Corporation Tax Return RI-1120C with Schedule CRS. This extension provides another month

for filing Form RI-1120C with Schedule CRS in addition to the automatic six (6) month extension allowed by

filing Form RI-7004. You must have filed Form RI-7004 timely in order to file Form RI-7004-CRS.

TO BE EFFECTIVE:

1. Payment of the full amount of the tax reasonably estimated to be due must be submitted with this request.

2. This form must be completed and filed before the date prescribed for payment of the tax.

3. This form must be signed by a person authorized to represent the corporation in this matter.

NOTE:

The extension of time is limited to:

1. The date requested, or

2. The date on which a certificate of good standing is required to be issued, whichever is earlier.

ONLINE PAYMENT

Your extension payment can be made online. For more information, visit:

https://

If you make your payment online, you do not need to send in this extension request form.

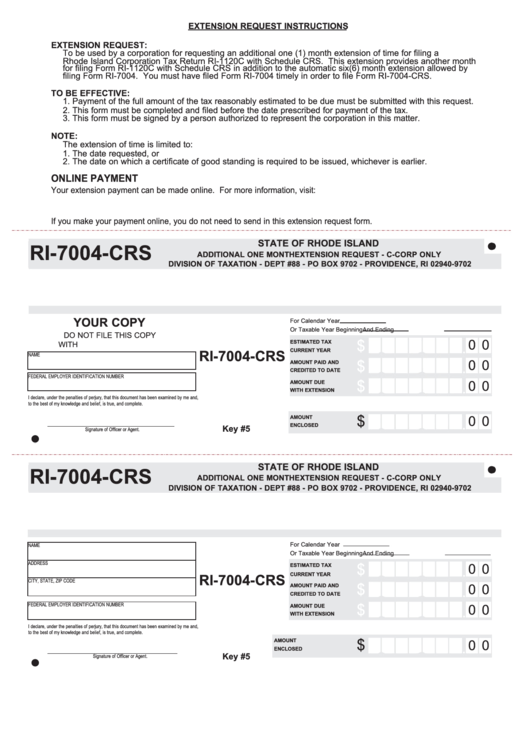

STATE OF RHODE ISLAND

RI-7004-CRS

ADDITIONAL ONE MONTH EXTENSION REQUEST - C-CORP ONLY

DIVISION OF TAXATION - DEPT #88 - PO BOX 9702 - PROVIDENCE, RI 02940-9702

YOUR COPY

For Calendar Year

Or Taxable Year Beginning

And Ending

DO NOT FILE THIS COPY

ESTIMATED TAX

$

0 0

WITH R.I. DIV. OF TAXATION

CURRENT YEAR

RI-7004-CRS

NAME

AMOUNT PAID AND

$

0 0

CREDITED TO DATE

FEDERAL EMPLOYER IDENTIFICATION NUMBER

AMOUNT DUE

$

0 0

WITH EXTENSION

I declare, under the penalties of perjury, that this document has been examined by me and,

to the best of my knowledge and belief, is true, and complete.

AMOUNT

$

0 0

ENCLOSED

Key #5

Signature of Officer or Agent.

STATE OF RHODE ISLAND

RI-7004-CRS

ADDITIONAL ONE MONTH EXTENSION REQUEST - C-CORP ONLY

DIVISION OF TAXATION - DEPT #88 - PO BOX 9702 - PROVIDENCE, RI 02940-9702

For Calendar Year

NAME

Or Taxable Year Beginning

And Ending

ADDRESS

ESTIMATED TAX

$

0 0

CURRENT YEAR

RI-7004-CRS

CITY, STATE, ZIP CODE

AMOUNT PAID AND

$

0 0

CREDITED TO DATE

FEDERAL EMPLOYER IDENTIFICATION NUMBER

AMOUNT DUE

$

0 0

WITH EXTENSION

I declare, under the penalties of perjury, that this document has been examined by me and,

to the best of my knowledge and belief, is true, and complete.

AMOUNT

$

0 0

ENCLOSED

Key #5

Signature of Officer or Agent.

1

1