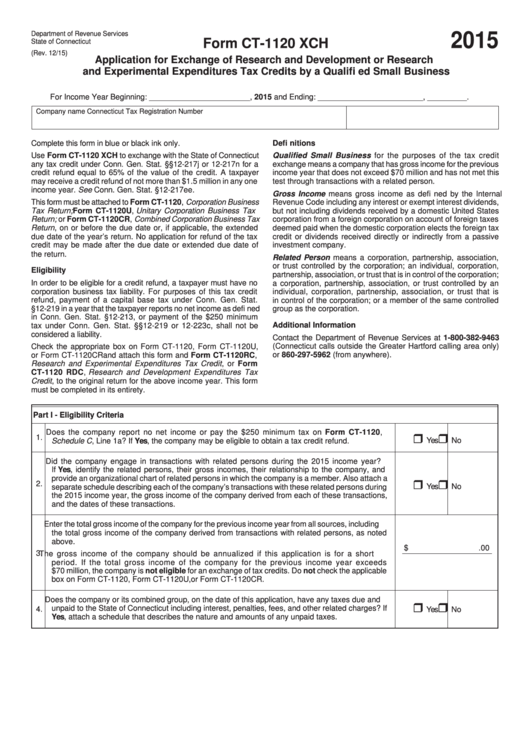

Form Ct-1120 Xch - Connecticut Application For Exchange Of Research And Development Or Research And Experimental Expenditures Tax Credits By A Qualifi Ed Small Business - 2015

ADVERTISEMENT

Department of Revenue Services

2015

Form CT-1120 XCH

State of Connecticut

(Rev. 12/15)

Application for Exchange of Research and Development or Research

and Experimental Expenditures Tax Credits by a Qualifi ed Small Business

For Income Year Beginning: _______________________ , 2015 and Ending: ________________________ , _________ .

Company name

Connecticut Tax Registration Number

Complete this form in blue or black ink only.

Defi nitions

Use Form CT-1120 XCH to exchange with the State of Connecticut

Qualified Small Business for the purposes of the tax credit

any tax credit under Conn. Gen. Stat. §§12-217j or 12-217n for a

exchange means a company that has gross income for the previous

credit refund equal to 65% of the value of the credit. A taxpayer

income year that does not exceed $70 million and has not met this

may receive a credit refund of not more than $1.5 million in any one

test through transactions with a related person.

income year. See Conn. Gen. Stat. §12-217ee.

Gross Income means gross income as defi ned by the Internal

This form must be attached to Form CT-1120, Corporation Business

Revenue Code including any interest or exempt interest dividends,

Tax Return; Form CT-1120U, Unitary Corporation Business Tax

but not including dividends received by a domestic United States

Return; or Form CT-1120CR, Combined Corporation Business Tax

corporation from a foreign corporation on account of foreign taxes

Return, on or before the due date or, if applicable, the extended

deemed paid when the domestic corporation elects the foreign tax

due date of the year’s return. No application for refund of the tax

credit or dividends received directly or indirectly from a passive

credit may be made after the due date or extended due date of

investment company.

the return.

Related Person means a corporation, partnership, association,

or trust controlled by the corporation; an individual, corporation,

Eligibility

partnership, association, or trust that is in control of the corporation;

In order to be eligible for a credit refund, a taxpayer must have no

a corporation, partnership, association, or trust controlled by an

corporation business tax liability. For purposes of this tax credit

individual, corporation, partnership, association, or trust that is

refund, payment of a capital base tax under Conn. Gen. Stat.

in control of the corporation; or a member of the same controlled

§12-219 in a year that the taxpayer reports no net income as defi ned

group as the corporation.

in Conn. Gen. Stat. §12-213, or payment of the $250 minimum

Additional Information

tax under Conn. Gen. Stat. §§12-219 or 12-223c, shall not be

considered a liability.

Contact the Department of Revenue Services at 1-800-382-9463

(Connecticut calls outside the Greater Hartford calling area only)

Check the appropriate box on Form CT-1120, Form CT-1120U,

or 860-297-5962 (from anywhere).

or Form CT-1120CR and attach this form and Form CT-1120RC,

Research and Experimental Expenditures Tax Credit, or Form

CT-1120 RDC, Research and Development Expenditures Tax

Credit, to the original return for the above income year. This form

must be completed in its entirety.

Part I - Eligibility Criteria

Does the company report no net income or pay the $250 minimum tax on Form CT-1120,

1.

Yes

No

Schedule C, Line 1a? If Yes, the company may be eligible to obtain a tax credit refund.

Did the company engage in transactions with related persons during the 2015 income year?

If Yes, identify the related persons, their gross incomes, their relationship to the company, and

provide an organizational chart of related persons in which the company is a member. Also attach a

2.

Yes

No

separate schedule describing each of the company’s transactions with these related persons during

the 2015 income year, the gross income of the company derived from each of these transactions,

and the dates of these transactions.

Enter the total gross income of the company for the previous income year from all sources, including

the total gross income of the company derived from transactions with related persons, as noted

above.

$

.00

3.

The gross income of the company should be annualized if this application is for a short

period. If the total gross income of the company for the previous income year exceeds

$70 million, the company is not eligible for an exchange of tax credits. Do not check the applicable

box on Form CT-1120, Form CT-1120U, or Form CT-1120CR.

Does the company or its combined group, on the date of this application, have any taxes due and

unpaid to the State of Connecticut including interest, penalties, fees, and other related charges? If

4.

Yes

No

Yes, attach a schedule that describes the nature and amounts of any unpaid taxes.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2