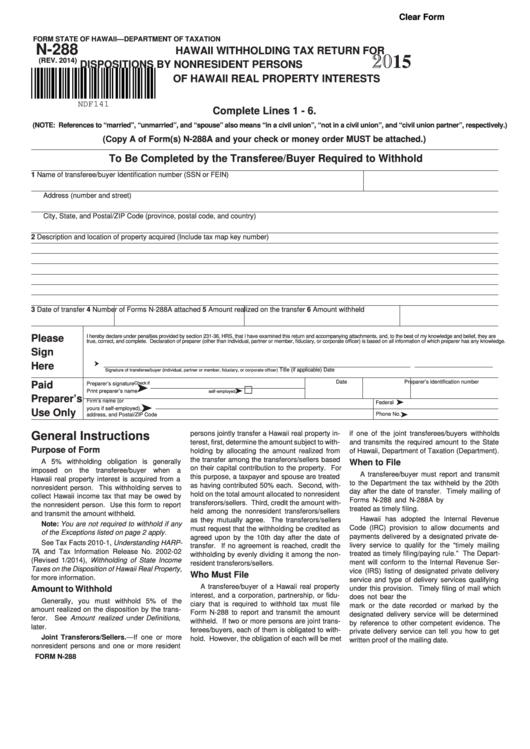

Clear Form

FORM

STATE OF HAWAII—DEPARTMENT OF TAXATION

N-288

HAWAII WITHHOLDING TAX RETURN FOR

2015

(REV. 2014)

DISPOSITIONS BY NONRESIDENT PERSONS

OF HAWAII REAL PROPERTY INTERESTS

NDF141

Complete Lines 1 - 6.

(NOTE: References to “married”, “unmarried”, and “spouse” also means “in a civil union”, “not in a civil union”, and “civil union partner”, respectively.)

(Copy A of Form(s) N-288A and your check or money order MUST be attached.)

To Be Completed by the Transferee/Buyer Required to Withhold

1

Name of transferee/buyer

Identification number (SSN or FEIN)

Address (number and street)

City, State, and Postal/ZIP Code (province, postal code, and country)

2

Description and location of property acquired (Include tax map key number)

3 Date of transfer

4 Number of Forms N-288A attached

5 Amount realized on the transfer

6 Amount withheld

Please

I hereby declare under penalties provided by section 231-36, HRS, that I have examined this return and accompanying attachments, and, to the best of my knowledge and belief, they are

true, correct, and complete. Declaration of preparer (other than individual, partner or member, fiduciary, or corporate officer) is based on all information of which preparer has any knowledge.

Sign

h _______________________________________________

_______________________________

____________________

Here

Signature of transferee/buyer (individual, partner or member, fiduciary, or corporate officer)

Title (if applicable)

Date

Date

Preparer’s identification number

Paid

Check if

ä

Preparer’s signature

ä

self-employed

Print preparer’s name

Preparer’s

ä

Firm’s name (or

Federal E.I. No.

ä

yours if self-employed),

Use Only

ä

Phone No.

address, and Postal/ZIP Code

persons jointly transfer a Hawaii real property in-

if one of the joint transferees/buyers withholds

General Instructions

terest, first, determine the amount subject to with-

and transmits the required amount to the State

Purpose of Form

holding by allocating the amount realized from

of Hawaii, Department of Taxation (Department).

the transfer among the transferors/sellers based

A 5% withholding obligation is generally

When to File

on their capital contribution to the property. For

imposed on the transferee/buyer when a

A transferee/buyer must report and transmit

this purpose, a taxpayer and spouse are treated

Hawaii real property interest is acquired from a

to the Department the tax withheld by the 20th

as having contributed 50% each. Second, with-

nonresident person. This withholding serves to

day after the date of transfer. Timely mailing of

hold on the total amount allocated to nonresident

collect Hawaii income tax that may be owed by

Forms N-288 and N-288A by U.S. mail will be

transferors/sellers. Third, credit the amount with-

the nonresident person. Use this form to report

treated as timely filing.

held among the nonresident transferors/sellers

and transmit the amount withheld.

Hawaii has adopted the Internal Revenue

as they mutually agree. The transferors/sellers

Note: You are not required to withhold if any

Code (IRC) provision to allow documents and

must request that the withholding be credited as

of the Exceptions listed on page 2 apply.

payments delivered by a designated private de-

agreed upon by the 10th day after the date of

See Tax Facts 2010-1, Understanding HARP-

livery service to qualify for the “timely mailing

transfer. If no agreement is reached, credit the

TA, and Tax Information Release No. 2002-02

treated as timely filing/paying rule.” The Depart-

withholding by evenly dividing it among the non-

(Revised 1/2014), Withholding of State Income

ment will conform to the Internal Revenue Ser-

resident transferors/sellers.

Taxes on the Disposition of Hawaii Real Property,

vice (IRS) listing of designated private delivery

Who Must File

for more information.

service and type of delivery services qualifying

A transferee/buyer of a Hawaii real property

Amount to Withhold

under this provision. Timely filing of mail which

interest, and a corporation, partnership, or fidu-

does not bear the U.S. Post Office cancellation

Generally, you must withhold 5% of the

ciary that is required to withhold tax must file

mark or the date recorded or marked by the

amount realized on the disposition by the trans-

Form N-288 to report and transmit the amount

designated delivery service will be determined

feror. See Amount realized under Definitions,

withheld. If two or more persons are joint trans-

by reference to other competent evidence. The

later.

ferees/buyers, each of them is obligated to with-

private delivery service can tell you how to get

Joint Transferors/Sellers.—If one or more

hold. However, the obligation of each will be met

written proof of the mailing date.

nonresident persons and one or more resident

FORM N-288

1

1 2

2