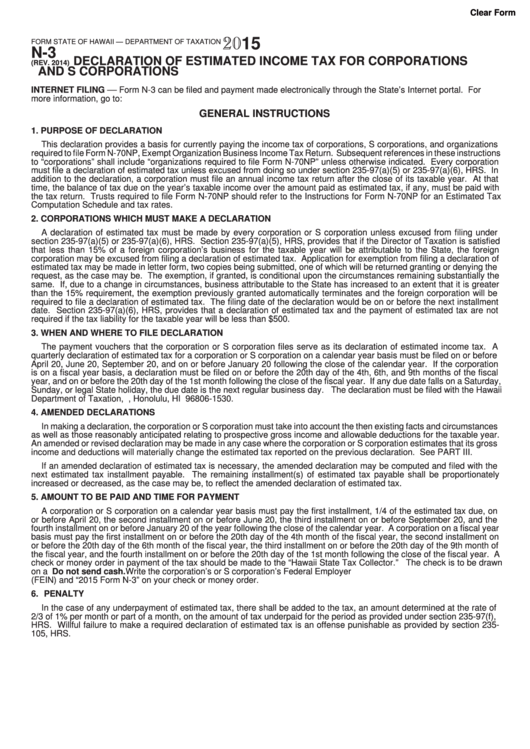

Form N-3 - Declaration Of Estimated Income Tax For Corporations And S Corporations - 2015

ADVERTISEMENT

Clear Form

2015

FORM

STATE OF HAWAII — DEPARTMENT OF TAXATION

N-3

DECLARATION OF ESTIMATED INCOME TAX FOR CORPORATIONS

(REV. 2014)

AND S CORPORATIONS

INTERNET FILING –– Form N-3 can be filed and payment made electronically through the State’s Internet portal. For

more information, go to: tax.hawaii.gov/eservices/

GENERAL INSTRUCTIONS

1. PURPOSE OF DECLARATION

This declaration provides a basis for currently paying the income tax of corporations, S corporations, and organizations

required to file Form N-70NP, Exempt Organization Business Income Tax Return. Subsequent references in these instructions

to “corporations” shall include “organizations required to file Form N-70NP” unless otherwise indicated. Every corporation

must file a declaration of estimated tax unless excused from doing so under section 235-97(a)(5) or 235-97(a)(6), HRS. In

addition to the declaration, a corporation must file an annual income tax return after the close of its taxable year. At that

time, the balance of tax due on the year’s taxable income over the amount paid as estimated tax, if any, must be paid with

the tax return. Trusts required to file Form N-70NP should refer to the Instructions for Form N-70NP for an Estimated Tax

Computation Schedule and tax rates.

2. CORPORATIONS WHICH MUST MAKE A DECLARATION

A declaration of estimated tax must be made by every corporation or S corporation unless excused from filing under

section 235-97(a)(5) or 235-97(a)(6), HRS. Section 235-97(a)(5), HRS, provides that if the Director of Taxation is satisfied

that less than 15% of a foreign corporation’s business for the taxable year will be attributable to the State, the foreign

corporation may be excused from filing a declaration of estimated tax. Application for exemption from filing a declaration of

estimated tax may be made in letter form, two copies being submitted, one of which will be returned granting or denying the

request, as the case may be. The exemption, if granted, is conditional upon the circumstances remaining substantially the

same. If, due to a change in circumstances, business attributable to the State has increased to an extent that it is greater

than the 15% requirement, the exemption previously granted automatically terminates and the foreign corporation will be

required to file a declaration of estimated tax. The filing date of the declaration would be on or before the next installment

date. Section 235-97(a)(6), HRS, provides that a declaration of estimated tax and the payment of estimated tax are not

required if the tax liability for the taxable year will be less than $500.

3. WHEN AND WHERE TO FILE DECLARATION

The payment vouchers that the corporation or S corporation files serve as its declaration of estimated income tax. A

quarterly declaration of estimated tax for a corporation or S corporation on a calendar year basis must be filed on or before

April 20, June 20, September 20, and on or before January 20 following the close of the calendar year. If the corporation

is on a fiscal year basis, a declaration must be filed on or before the 20th day of the 4th, 6th, and 9th months of the fiscal

year, and on or before the 20th day of the 1st month following the close of the fiscal year. If any due date falls on a Saturday,

Sunday, or legal State holiday, the due date is the next regular business day. The declaration must be filed with the Hawaii

Department of Taxation, P.O. Box 1530, Honolulu, HI 96806-1530.

4. AMENDED DECLARATIONS

In making a declaration, the corporation or S corporation must take into account the then existing facts and circumstances

as well as those reasonably anticipated relating to prospective gross income and allowable deductions for the taxable year.

An amended or revised declaration may be made in any case where the corporation or S corporation estimates that its gross

income and deductions will materially change the estimated tax reported on the previous declaration. See PART III.

If an amended declaration of estimated tax is necessary, the amended declaration may be computed and filed with the

next estimated tax installment payable. The remaining installment(s) of estimated tax payable shall be proportionately

increased or decreased, as the case may be, to reflect the amended declaration of estimated tax.

5. AMOUNT TO BE PAID AND TIME FOR PAYMENT

A corporation or S corporation on a calendar year basis must pay the first installment, 1/4 of the estimated tax due, on

or before April 20, the second installment on or before June 20, the third installment on or before September 20, and the

fourth installment on or before January 20 of the year following the close of the calendar year. A corporation on a fiscal year

basis must pay the first installment on or before the 20th day of the 4th month of the fiscal year, the second installment on

or before the 20th day of the 6th month of the fiscal year, the third installment on or before the 20th day of the 9th month of

the fiscal year, and the fourth installment on or before the 20th day of the 1st month following the close of the fiscal year. A

check or money order in payment of the tax should be made to the “Hawaii State Tax Collector.” The check is to be drawn

on a U.S. bank in U.S. dollars. Do not send cash. Write the corporation’s or S corporation’s Federal Employer I.D. Number

(FEIN) and “2015 Form N-3” on your check or money order.

6. PENALTY

In the case of any underpayment of estimated tax, there shall be added to the tax, an amount determined at the rate of

2/3 of 1% per month or part of a month, on the amount of tax underpaid for the period as provided under section 235-97(f),

HRS. Willful failure to make a required declaration of estimated tax is an offense punishable as provided by section 235-

105, HRS.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6