Instructions For Arizona Schedule K-1 (Form 141az) - Resident Or Part-Year Resident Beneficiary'S Share Of Fiduciary Adjustment - 2014

ADVERTISEMENT

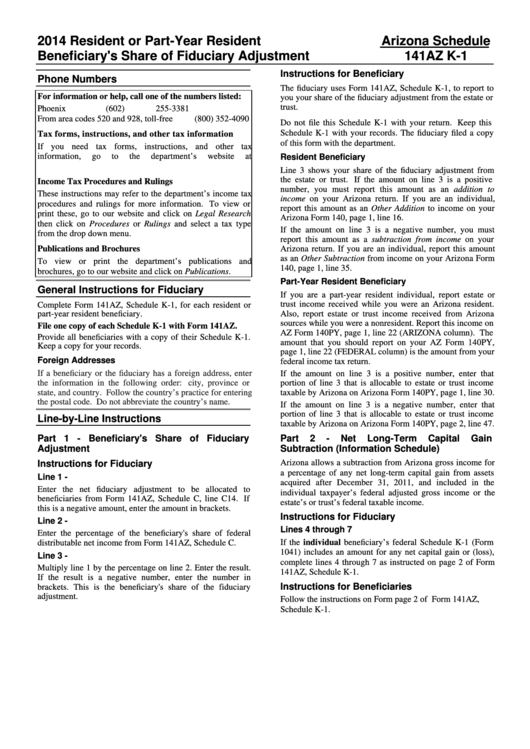

2014 Resident or Part-Year Resident

Arizona Schedule

Beneficiary's Share of Fiduciary Adjustment

141AZ K-1

Instructions for Beneficiary

Phone Numbers

The fiduciary uses Form 141AZ, Schedule K-1, to report to

For information or help, call one of the numbers listed:

you your share of the fiduciary adjustment from the estate or

trust.

Phoenix

(602) 255-3381

From area codes 520 and 928, toll-free

(800) 352-4090

Do not file this Schedule K-1 with your return. Keep this

Schedule K-1 with your records. The fiduciary filed a copy

Tax forms, instructions, and other tax information

of this form with the department.

If you need tax forms, instructions, and other tax

information,

go

to

the

department’s

website

at

Resident Beneficiary

Line 3 shows your share of the fiduciary adjustment from

the estate or trust. If the amount on line 3 is a positive

Income Tax Procedures and Rulings

number, you must report this amount as an addition to

These instructions may refer to the department’s income tax

income on your Arizona return. If you are an individual,

procedures and rulings for more information. To view or

report this amount as an Other Addition to income on your

print these, go to our website and click on Legal Research

Arizona Form 140, page 1, line 16.

then click on Procedures or Rulings and select a tax type

If the amount on line 3 is a negative number, you must

from the drop down menu.

report this amount as a subtraction from income on your

Publications and Brochures

Arizona return. If you are an individual, report this amount

as an Other Subtraction from income on your Arizona Form

To view or print the department’s publications and

140, page 1, line 35.

brochures, go to our website and click on Publications.

Part-Year Resident Beneficiary

General Instructions for Fiduciary

If you are a part-year resident individual, report estate or

trust income received while you were an Arizona resident.

Complete Form 141AZ, Schedule K-1, for each resident or

Also, report estate or trust income received from Arizona

part-year resident beneficiary.

sources while you were a nonresident. Report this income on

File one copy of each Schedule K-1 with Form 141AZ.

AZ Form 140PY, page 1, line 22 (ARIZONA column). The

Provide all beneficiaries with a copy of their Schedule K-1.

amount that you should report on your AZ Form 140PY,

Keep a copy for your records.

page 1, line 22 (FEDERAL column) is the amount from your

Foreign Addresses

federal income tax return.

If a beneficiary or the fiduciary has a foreign address, enter

If the amount on line 3 is a positive number, enter that

the information in the following order: city, province or

portion of line 3 that is allocable to estate or trust income

state, and country. Follow the country’s practice for entering

taxable by Arizona on Arizona Form 140PY, page 1, line 30.

the postal code. Do not abbreviate the country’s name.

If the amount on line 3 is a negative number, enter that

portion of line 3 that is allocable to estate or trust income

Line-by-Line Instructions

taxable by Arizona on Arizona Form 140PY, page 2, line 47.

Part 1 - Beneficiary's Share of Fiduciary

Part

2

-

Net

Long-Term

Capital

Gain

Adjustment

Subtraction (Information Schedule)

Arizona allows a subtraction from Arizona gross income for

Instructions for Fiduciary

a percentage of any net long-term capital gain from assets

Line 1 -

acquired after December 31, 2011, and included in the

Enter the net fiduciary adjustment to be allocated to

individual taxpayer’s federal adjusted gross income or the

beneficiaries from Form 141AZ, Schedule C, line C14. If

estate’s or trust’s federal taxable income.

this is a negative amount, enter the amount in brackets.

Instructions for Fiduciary

Line 2 -

Lines 4 through 7

Enter the percentage of the beneficiary's share of federal

If the individual beneficiary’s federal Schedule K-1 (Form

distributable net income from Form 141AZ, Schedule C.

1041) includes an amount for any net capital gain or (loss),

Line 3 -

complete lines 4 through 7 as instructed on page 2 of Form

Multiply line 1 by the percentage on line 2. Enter the result.

141AZ, Schedule K-1.

If the result is a negative number, enter the number in

Instructions for Beneficiaries

brackets. This is the beneficiary's share of the fiduciary

adjustment.

Follow the instructions on Form page 2 of Form 141AZ,

Schedule K-1.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1