Form I-348 - Composite Filing Instructions

ADVERTISEMENT

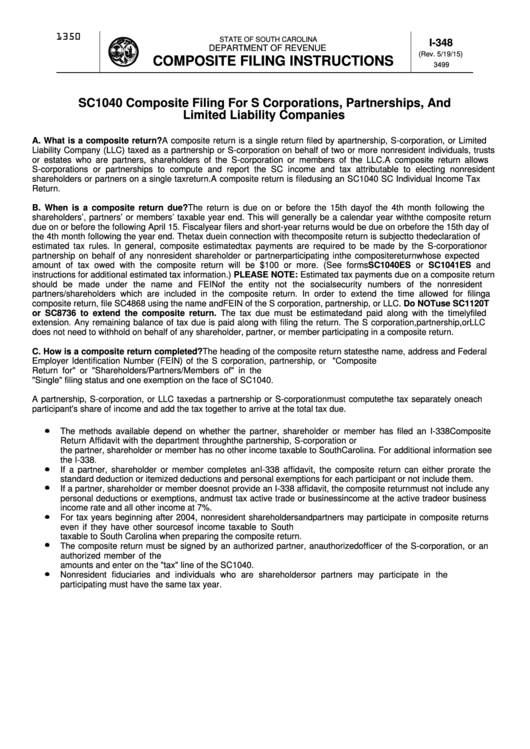

1350

STATE OF SOUTH CAROLINA

I-348

DEPARTMENT OF REVENUE

(Rev. 5/19/15)

COMPOSITE FILING INSTRUCTIONS

3499

SC1040 Composite Filing For S Corporations, Partnerships, And

Limited Liability Companies

A. What is a composite return? A composite return is a single return filed by a partnership, S-corporation, or Limited

Liability Company (LLC) taxed as a partnership or S-corporation on behalf of two or more nonresident individuals, trusts

or estates who are partners, shareholders of the S-corporation or members of the LLC. A composite return allows

S-corporations or partnerships to compute and report the SC income and tax attributable to electing nonresident

shareholders or partners on a single tax return. A composite return is filed using an SC1040 SC Individual Income Tax

Return.

B. When is a composite return due? The return is due on or before the 15th day of the 4th month following the

shareholders’, partners’ or members’ taxable year end. This will generally be a calendar year with the composite return

due on or before the following April 15. Fiscal year filers and short-year returns would be due on or before the 15th day of

the 4th month following the year end. The tax due in connection with the composite return is subject to the declaration of

estimated tax rules. In general, composite estimated tax payments are required to be made by the S-corporation or

partnership on behalf of any nonresident shareholder or partner participating in the composite return whose expected

amount of tax owed with the composite return will be $100 or more. (See forms SC1040ES or SC1041ES and

instructions for additional estimated tax information.) PLEASE NOTE: Estimated tax payments due on a composite return

should be made under the name and FEIN of the entity not the social security numbers of the nonresident

partners/shareholders which are included in the composite return. In order to extend the time allowed for filing a

composite return, file SC4868 using the name and FEIN of the S corporation, partnership, or LLC. Do NOT use SC1120T

or SC8736 to extend the composite return. The tax due must be estimated and paid along with the timely filed

extension. Any remaining balance of tax due is paid along with filing the return. The S corporation, partnership, or LLC

does not need to withhold on behalf of any shareholder, partner, or member participating in a composite return.

C. How is a composite return completed? The heading of the composite return states the name, address and Federal

Employer Identification Number (FEIN) of the S corporation, partnership, or LLC. There is no need to use "Composite

Return for" or "Shareholders/Partners/Members of" in the name. Mark the box for filing a composite return. Mark

"Single" filing status and one exemption on the face of SC1040.

A partnership, S-corporation, or LLC taxed as a partnership or S-corporation must compute the tax separately on each

participant's share of income and add the tax together to arrive at the total tax due.

The methods available depend on whether the partner, shareholder or member has filed an I-338 Composite

Return Affidavit with the department through the partnership, S-corporation or LLC. An I-338 affidavit states that

the partner, shareholder or member has no other income taxable to South Carolina. For additional information see

the I-338.

If a partner, shareholder or member completes an I-338 affidavit, the composite return can either prorate the

standard deduction or itemized deductions and personal exemptions for each participant or not include them.

If a partner, shareholder or member does not provide an I-338 affidavit, the composite return must not include any

personal deductions or exemptions, and must tax active trade or business income at the active trade or business

income rate and all other income at 7%.

For tax years beginning after 2004, nonresident shareholders and partners may participate in composite returns

even if they have other sources of income taxable to South Carolina. Disregard the other sources of income

taxable to South Carolina when preparing the composite return.

The composite return must be signed by an authorized partner, an authorized officer of the S-corporation, or an

authorized member of the LLC. Attach a schedule showing the separate computations. Total the separate tax

amounts and enter on the "tax" line of the SC1040.

Nonresident fiduciaries and individuals who are shareholders or partners may participate in the filing. All

participating must have the same tax year.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1