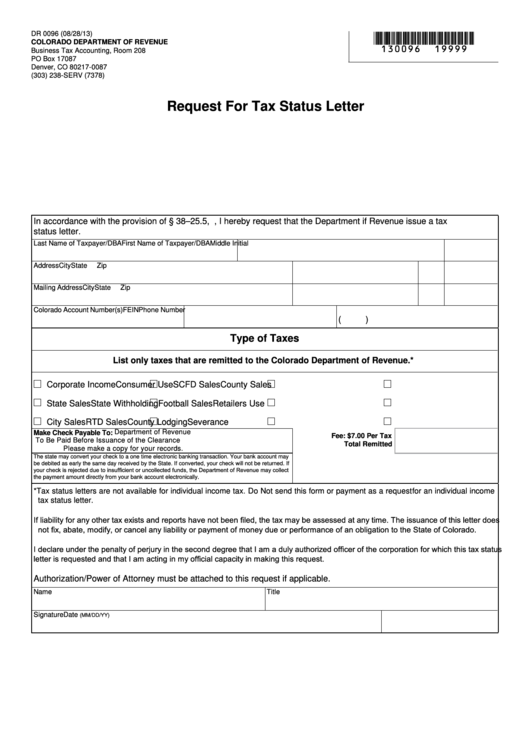

DR 0096 (08/28/13)

*130096==19999*

COLORADO DEPARTMENT OF REVENUE

Business Tax Accounting, Room 208

PO Box 17087

Denver, CO 80217-0087

(303) 238-SERV (7378)

Request For Tax Status Letter

In accordance with the provision of § 38–25.5, C.R.S., I hereby request that the Department if Revenue issue a tax

status letter.

Last Name of Taxpayer/DBA

First Name of Taxpayer/DBA

Middle Initial

Address

City

State

Zip

Mailing Address

City

State

Zip

Colorado Account Number(s)

FEIN

Phone Number

(

)

Type of Taxes

List only taxes that are remitted to the Colorado Department of Revenue.*

Corporate Income

Consumer Use

SCFD Sales

County Sales

State Sales

State Withholding

Football Sales

Retailers Use

City Sales

RTD Sales

County Lodging

Severance

Department of Revenue

Make Check Payable To:

Fee: $7.00 Per Tax

To Be Paid Before Issuance of the Clearance

Total Remitted

Please make a copy for your records.

The state may convert your check to a one time electronic banking transaction. Your bank account may

be debited as early the same day received by the State. If converted, your check will not be returned. If

your check is rejected due to insufficient or uncollected funds, the Department of Revenue may collect

the payment amount directly from your bank account electronically.

* Tax status letters are not available for individual income tax. Do Not send this form or payment as a request for an individual income

tax status letter.

If liability for any other tax exists and reports have not been filed, the tax may be assessed at any time. The issuance of this letter does

not fix, abate, modify, or cancel any liability or payment of money due or performance of an obligation to the State of Colorado.

I declare under the penalty of perjury in the second degree that I am a duly authorized officer of the corporation for which this tax status

letter is requested and that I am acting in my official capacity in making this request.

Authorization/Power of Attorney must be attached to this request if applicable.

Name

Title

Signature

Date

(MM/DD/YY)

1

1