Form Au-801 - Reinstatement Guarantee Declaration For Stock Corporations

ADVERTISEMENT

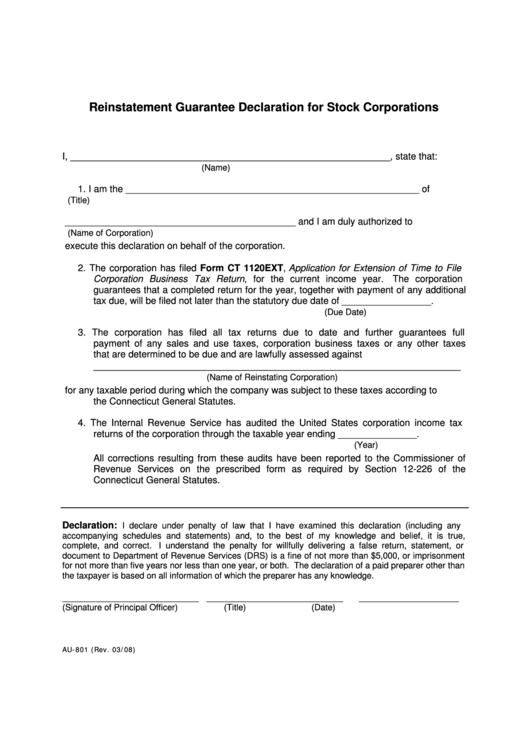

Reinstatement Guarantee Declaration for Stock Corporations

I, _____________________________________________________________, state that:

(Name)

1. I am the ________________________________________________________ of

(Title)

____________________________________________ and I am duly authorized to

(Name of Corporation)

execute this declaration on behalf of the corporation.

2. The corporation has filed Form CT 1120EXT, Application for Extension of Time to File

Corporation Business Tax Return, for the current income year.

The corporation

guarantees that a completed return for the year, together with payment of any additional

tax due, will be filed not later than the statutory due date of _________________.

(Due Date)

3. The corporation has filed all tax returns due to date and further guarantees full

payment of any sales and use taxes, corporation business taxes or any other taxes

that are determined to be due and are lawfully assessed against

______________________________________________________________________

(Name of Reinstating Corporation)

for any taxable period during which the company was subject to these taxes according to

the Connecticut General Statutes.

4. The Internal Revenue Service has audited the United States corporation income tax

returns of the corporation through the taxable year ending _______________.

(Year)

All corrections resulting from these audits have been reported to the Commissioner of

Revenue Services on the prescribed form as required by Section 12-226 of the

Connecticut General Statutes.

Declaration:

I declare under penalty of law that I have examined this declaration (including any

accompanying schedules and statements) and, to the best of my knowledge and belief, it is true,

complete, and correct. I understand the penalty for willfully delivering a false return, statement, or

document to Department of Revenue Services (DRS) is a fine of not more than $5,000, or imprisonment

for not more than five years nor less than one year, or both. The declaration of a paid preparer other than

the taxpayer is based on all information of which the preparer has any knowledge.

__________________________ __________________________

___________________

(Signature of Principal Officer)

(Title)

(Date)

AU-801 (Rev. 03/08)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1