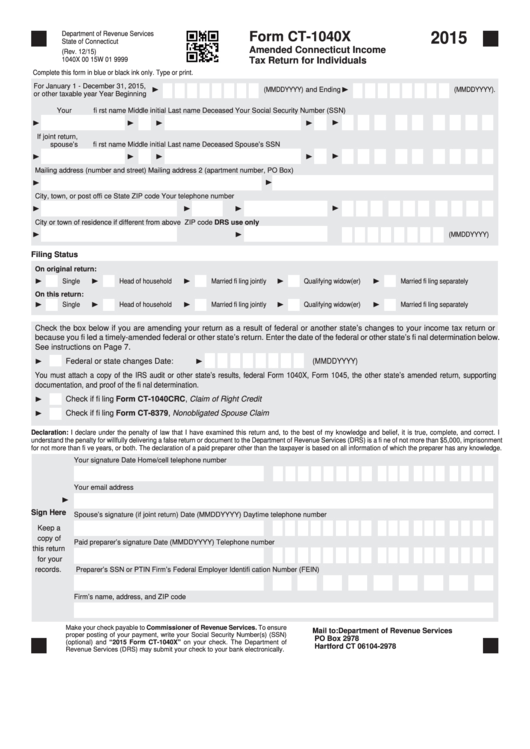

Form Ct-1040x - Amended Connecticut Income Tax Return For Individuals - 2015

ADVERTISEMENT

Department of Revenue Services

Form CT-1040X

2015

State of Connecticut

Amended Connecticut Income

(Rev. 12/15)

1040X 00 15W 01 9999

Tax Return for Individuals

Complete this form in blue or black ink only. Type or print.

For January 1 - December 31, 2015,

(MMDDYYYY) and Ending

(MMDDYYYY).

or other taxable year Year Beginning

Your fi rst name

Middle initial

Last name

Deceased

Your Social Security Number (SSN)

If joint return,

spouse’s fi rst name

Middle initial

Last name

Deceased

Spouse’s SSN

Mailing address (number and street)

Mailing address 2 (apartment number, PO Box)

City, town, or post offi ce

State

ZIP code

Your telephone number

City or town of residence if different from above

ZIP code

DRS use only

(MMDDYYYY)

Filing Status

On original return:

Single

Head of household

Married fi ling jointly

Qualifying widow(er)

Married fi ling separately

On this return:

Single

Head of household

Married fi ling jointly

Qualifying widow(er)

Married fi ling separately

Check the box below if you are amending your return as a result of federal or another state’s changes to your income tax return or

because you fi led a timely-amended federal or other state’s return. Enter the date of the federal or other state’s fi nal determination below.

See instructions on Page 7.

Federal or state changes

Date:

(MMDDYYYY)

You must attach a copy of the IRS audit or other state’s results, federal Form 1040X, Form 1045, the other state’s amended return, supporting

documentation, and proof of the fi nal determination.

Check if fi ling Form CT-1040CRC, Claim of Right Credit

Check if fi ling Form CT-8379, Nonobligated Spouse Claim

Declaration: I declare under the penalty of law that I have examined this return and, to the best of my knowledge and belief, it is true, complete, and correct. I

understand the penalty for willfully delivering a false return or document to the Department of Revenue Services (DRS) is a fi ne of not more than $5,000, imprisonment

for not more than fi ve years, or both. The declaration of a paid preparer other than the taxpayer is based on all information of which the preparer has any knowledge.

Your signature

Date

Home/cell telephone number

Your email address

Sign Here

Spouse’s signature (if joint return)

Date (MMDDYYYY)

Daytime telephone number

Keep a

copy of

Paid preparer’s signature

Date (MMDDYYYY)

Telephone number

this return

for your

records.

Preparer’s SSN or PTIN

Firm’s Federal Employer Identifi cation Number (FEIN)

Firm’s name, address, and ZIP code

Make your check payable to Commissioner of Revenue Services. To ensure

Mail to:

Department of Revenue Services

proper posting of your payment, write your Social Security Number(s) (SSN)

PO Box 2978

(optional) and “2015 Form CT-1040X” on your check. The Department of

Hartford CT 06104-2978

Revenue Services (DRS) may submit your check to your bank electronically.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12