41A720-S28 (10-15)

Page 2

Commonwealth of Kentucky

INSTRUCTIONS—SCHEDULE KJDA-T

DEPARTMENT OF REVENUE

PURPOSE OF SCHEDULE—This schedule is used by a

Column B—For the taxable year that includes the activation

company which has entered into a service and technology

date of the service and technology agreement, enter 50

agreement for a Kentucky Jobs Development Act (KJDA)

percent of the total start-up costs as verified by the Kentucky

project to maintain a record of the approved costs, wage

Economic Development Finance Authority. For each year

assessments, in-lieu-of credits and tax credits (income tax

thereafter, if the amount entered in Column F for the prior

and limited liability entity tax) for the duration of the service

year exceeds the amount entered in Column G for the prior

and technology agreement. This information is necessary

year, enter the difference. If the amount entered in Column

for the company to determine the limitation of the tax credit

G for the prior year equals the amount entered in Column

for each year of the service and technology agreement and

F for the prior year, enter zero (-0-).

to allow the Kentucky Department of Revenue to verify that

the credit has been properly computed.

Column C—Enter 50 percent of rental payments made

during the taxable year as set forth in the service and

GENERAL INSTRUCTIONS

technology agreement.

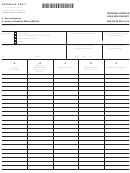

A s i n g l e S c h e d u l e K J D A -T, Tr a c k i n g S c h e d u l e

Column D—Enter the total amount of employee wage

for a KJDA Project, shall be maintained for the duration of

assessments (both the state and local portion) withheld

each KJDA project. Beginning with the first taxable year

from the salaries of employees during the taxable year.

of the KJDA service and technology agreement, complete

Columns A through G using a separate line for each year of

Column E—If the local jurisdiction where the project is

the service and technology agreement. The company shall

located elected to provide in-lieu-of credits as provided by

attach a copy of this schedule updated with current year

KRS 154.24-150(1) and (2), enter the amount of in-lieu-of

information to the Schedule KJDA or Schedule KJDA-SP

credits received during the taxable year.

which is filed with the Kentucky tax return for the year.

Column F—Enter the result of adding the amounts entered

For Form 720, all tax credits are entered on Schedule

in Columns B and C and subtracting the amounts entered

TCS, Tax Credit Summary Schedule. The total tax credits

in Columns D and E. Also, enter on Schedule KJDA, Part

calculated may exceed the amount that can be used. Credits

III, Line 2 or Schedule KJDA-SP, Part I, Line 8, whichever is

must be claimed in the order prescribed by KRS 141.0205.

applicable.

Total credits claimed cannot reduce the LLET below the $175

minimum . Total credits claimed cannot reduce the income

Column G—The KJDA tax credit is applied against the

tax liability below zero.

corporation income tax imposed under KRS 141.040 and/or

the limited liability entity tax imposed under KRS 141.0401.

SPECIFIC INSTRUCTIONS

The tax credit calculated for each tax can be different;

however, for tracking purposes, the maximum amount used

Column A—Enter on each line the ending date (month and

against either tax is recorded as amount claimed. Enter the

year) of the taxable year for which the information requested

greater of Column E or Column F from Schedule TCS for

in Columns B through G is entered.

this project.

1

1 2

2