Form M-941d Wr - Quarterly Return Of Income Taxes Withheld For Employer Paying Weekly

ADVERTISEMENT

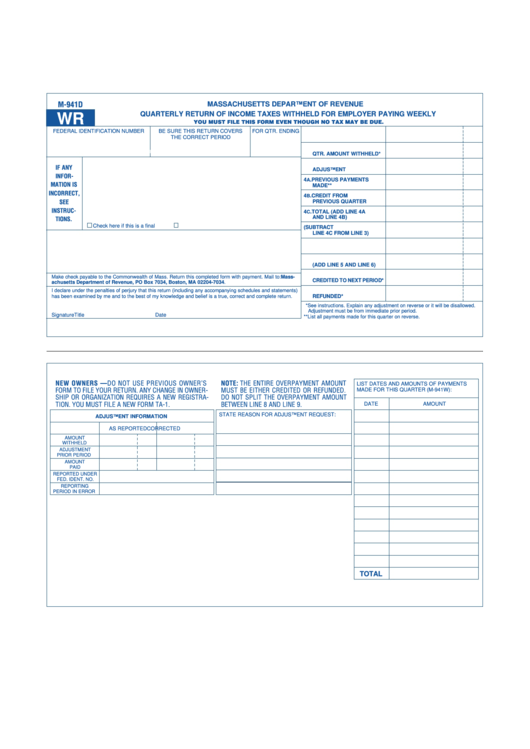

MASSACHUSETTS DEPARTMENT OF REVENUE

M-941D

QUARTERLY RETURN OF INCOME TAXES WITHHELD FOR EMPLOYER PAYING WEEKLY

WR

YOU MUST FILE THIS FORM EVEN THOUGH NO TAX MAY BE DUE.

FEDERAL IDENTIFICATION NUMBER

BE SURE THIS RETURN COVERS

FOR QTR. ENDING

1. AMOUNT WITHHELD

THE CORRECT PERIOD

2. ADJUSTMENT FOR PRIOR

IF INCORRECT, SEE INSTRUCTIONS. DO NOT ALTER.

QTR. AMOUNT WITHHELD*

3. AMOUNT DUE AFTER

IF ANY

ADJUSTMENT

INFOR-

4

A

. PREVIOUS PAYMENTS

MATION IS

MADE**

INCORRECT,

4

B

. CREDIT FROM

PREVIOUS QUARTER

SEE

INSTRUC-

4

C

. TOTAL (ADD LINE 4A

AND LINE 4B)

TIONS.

Check here if this is a final return.

Check here if EFT payment.

5. TOTAL TAX DUE (SUBTRACT

LINE 4C FROM LINE 3)

6. PENALTIES AND INTEREST

7. TOTAL AMOUNT DUE

(ADD LINE 5 AND LINE 6)

8. AMOUNT OVERPAID TO BE

Make check payable to the Commonwealth of Mass. Return this completed form with payment. Mail to: Mass-

CREDITED TO NEXT PERIOD*

achusetts Department of Revenue, PO Box 7034, Boston, MA 02204-7034.

I declare under the penalties of perjury that this return (including any accompanying schedules and statements)

9. AMOUNT OVERPAID TO BE

has been examined by me and to the best of my knowledge and belief is a true, correct and complete return.

REFUNDED*

*See instructions. Explain any adjustment on reverse or it will be disallowed.

Adjustment must be from immediate prior period.

Signature

Title

Date

**List all payments made for this quarter on reverse.

NEW OWNERS — DO NOT USE PREVIOUS OWNER’S

NOTE: THE ENTIRE OVERPAYMENT AMOUNT

LIST DATES AND AMOUNTS OF PAYMENTS

MADE FOR THIS QUARTER (M-941W):

FORM TO FILE YOUR RETURN. ANY CHANGE IN OWNER-

MUST BE EITHER CREDITED OR REFUNDED.

SHIP OR ORGANIZATION REQUIRES A NEW REGISTRA-

DO NOT SPLIT THE OVERPAYMENT AMOUNT

TION. YOU MUST FILE A NEW FORM TA-1.

BETWEEN LINE 8 AND LINE 9.

DATE

AMOUNT

STATE REASON FOR ADJUSTMENT REQUEST:

ADJUSTMENT INFORMATION

AS REPORTED

CORRECTED

AMOUNT

WITHHELD

ADJUSTMENT

PRIOR PERIOD

AMOUNT

PAID

REPORTED UNDER

FED. IDENT. NO.

REPORTING

PERIOD IN ERROR

TOTAL

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1