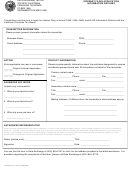

Temporary Exemption/Suspension Request

Temporary Exemptions

FTB is authorized to exempt a financial institution from the requirements of R&TC Section 19266(a)(2)(C), if FTB

determines that the financial institution’s participation would not generate sufficient revenue to be cost effective for FTB. A

temporary exemption applies to financial institutions holding less than 250 open accounts, unless it would be cost effective

for FTB to require the financial institution to comply with the requirements of the FIRM data match process. A financial

institution holding less than 250 open accounts may submit a Temporary Exemption Request to the FIRM Program

Administrator.

FTB reserves the right to require a financial institution that has been granted temporary exemption to complete and file

a FTB 2060, Election, with the FIRM Program Administrator and participate in the FIRM data match process. The FIRM

Program Administrator shall notify the financial institution in writing of the date that the FTB 2060, Election, is to be

submitted and the date that the financial institution shall begin participating in the FIRM data match process. If a financial

institution believes facts exist for FTB staff to grant a temporary exemption, the financial institution may submit and file a

Temporary Exemption Request with the FIRM Program Administrator. The financial institution shall provide sufficient detail

for FTB staff to evaluate its request.

FTB shall consider a financial institution’s Temporary Exemption Request and respond in writing to the financial institution

within sixty (60) calendar days of receipt of the Temporary Exemption Request. Unless otherwise stated, the temporary

exemption remains in effect for twelve months from the date of approval or until the FIRM Program Administrator receives

written notice from the financial institution that a change has occurred in the underlying facts that warranted the temporary

exemption.

Sixty days prior to expiration of the temporary exemption, a financial institution that seeks to renew its temporary

exemption status shall complete and submit a new Temporary Exemption Request to the FIRM Program Administrator.

Within sixty (60) calendar days of determining that the facts upon which the temporary exemption no longer exists, the

financial institution shall notify the FIRM Program Administrator of the change and shall file a FTB 2060, Election, with the

FIRM Program Administrator to begin participation in the exchange process.

Temporary Suspension

FTB is authorized to temporarily suspend a financial institution from the requirements of R&TC Section 19266(a)(2)(D), if

the financial institution provides FTB with a written notice from its supervisory banking authority that it is determined to be

undercapitalized, significantly undercapitalized, or critically undercapitalized as defined by FDIC Regulation 325.103(b)(3),

(4), and (5), or NCUA Regulation 702.102. The notice from the supervisory banking authority provided pursuant to this

subsection shall be subject to the non-disclosure protections of R&TC Section 19542.

A financial institution that requests a temporary suspension shall submit a Temporary Suspension Request to the FIRM

Program Administrator under forms and instructions provided by FTB. FTB shall consider the request and respond to the

financial institution in writing within sixty (60) calendar days of the request. If granted, the temporary suspension remains

in effect for twelve months from the date of approval. Sixty (60) calendar days prior to the expiration of the grant of the

temporary suspension, a financial institution that seeks to renew its temporary suspension status shall complete and

submit a new Temporary Suspension Request to the FIRM Program Administrator. Within sixty (60) calendar days of

receipt of a written notice from its supervisory banking authority removing the determination, the financial institution shall

notify the FIRM Program Administrator of its change in financial condition and shall file a FTB 2060, Election, with the

FIRM Program Administrator to begin participation in the exchange process.

Where to Send the Temporary Exemption/Suspension Form

Complete and sign PAGE 1 of this form. Fax it to 916.843.0267 or mail to: FIRM MS A243, FRANCHISE TAX BOARD,

PO BOX 1468, SACRAMENTO, CA 95812-1468.

Form Instructions

Your Institution’s Name and Contact Information: Enter your institution’s name exactly how it appears on the

FTB 2060, Election. Provide the name, phone number, and email address of the person within your financial institution

designated to answer questions about FIRM.

Type of Action Submitted: Answer one of the three categories and provide sufficient information for item 2 or 3

(if applicable).

FIRM Authorization: An authorized officer of your financial institution shall sign the form.

Assistance: To answer questions related to FIRM, email FTBFIRMhelp@ftb.ca.gov.

FTB 2058 PC (REV 08-2013) PAGE 2

1

1 2

2