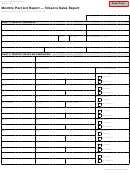

4855, Page 2

Invoice Number from Page 1

FEIN from Page 1

Reporting Period from Page 1

PARt 3: CeRtIfICAtIon

Under penalty of perjury, I verify I examined this report, and, to the best of my knowledge, it is true, correct and complete. I also verify such information

is taken from the books and records of the business for which this return is filed.

Signature of Owner/Officer

Phone Number

Title

Date

Signature of Owner/Officer

Phone Number

Title

Date

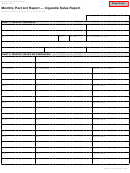

InStRuCtIonS foR foRM 4855,

Monthly Pact Act Report — Cigarette Sales Report

If you are a person who sells, transfers or ships cigarettes into the state of Michigan, you are required by federal

Law to file this report (Form 4855) with the state of Michigan. For additional information, see the Prevent All Cigarette

Trafficking (PACT) Act at 15 USC 376. Note that sales of roll-your-own tobacco or smokeless tobacco must be reported

on Form 4856.

Complete this report to show each invoice reflecting a sale of cigarettes into Michigan and every brand and quantity of

cigarettes listed on each of those invoices.

This report is due by the 10th day of the month following the month in which the cigarettes were shipped. Mail the

completed report to:

Tobacco Tax Unit

Michigan Department of Treasury

P.O. Box 30474

Lansing, MI 48909

It is important to note that other requirements of Michigan law may apply to persons who sell or plan to sell cigarettes

or other tobacco products in, or into, Michigan. These requirements may include, but are not limited to, licensing and

stamping of tobacco products. Note, too, that Michigan imposes serious penalties on those who violate these laws. If you

have any questions about your responsibilities, contact the Tobacco Tax Unit at (517) 636-4630.

1

1 2

2