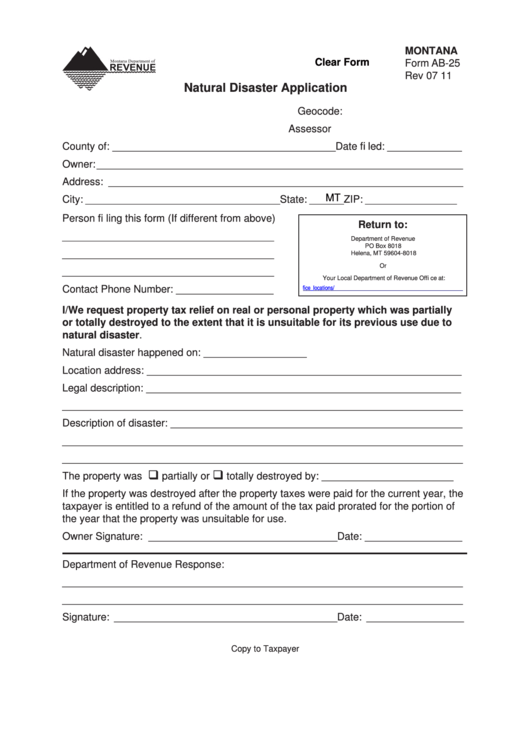

MONTANA

Clear Form

Form AB-25

Rev 07 11

Natural Disaster Application

Geocode: _____________________

Assessor #: _____________________

County of: _______________________________________ Date fi led: _____________

Owner: ________________________________________________________________

Address: ______________________________________________________________

MT

City: __________________________________ State: ______ ZIP: ________________

Person fi ling this form (If different from above)

Return to:

_____________________________________

Department of Revenue

PO Box 8018

_____________________________________

Helena, MT 59604-8018

Or

_____________________________________

Your Local Department of Revenue Offi ce at:

ce_locations/default.mcpx

Contact Phone Number: _________________

I/We request property tax relief on real or personal property which was partially

or totally destroyed to the extent that it is unsuitable for its previous use due to

natural disaster.

Natural disaster happened on: __________________

Location address: _______________________________________________________

Legal description: _______________________________________________________

______________________________________________________________________

Description of disaster: ___________________________________________________

______________________________________________________________________

______________________________________________________________________

The property was

partially or

totally destroyed by: _______________________

If the property was destroyed after the property taxes were paid for the current year, the

taxpayer is entitled to a refund of the amount of the tax paid prorated for the portion of

the year that the property was unsuitable for use.

Owner Signature: _________________________________ Date: _________________

Department of Revenue Response:

______________________________________________________________________

______________________________________________________________________

Signature: _______________________________________ Date: _________________

Copy to Taxpayer

1

1