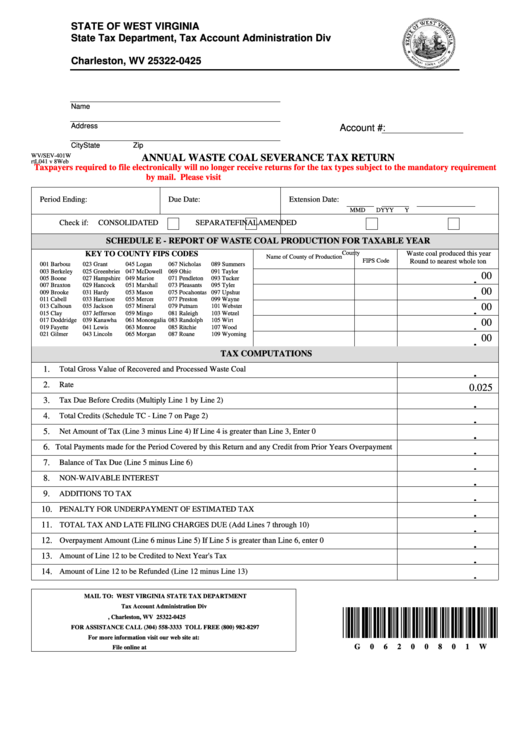

STATE OF WEST VIRGINIA

State Tax Department, Tax Account Administration Div

P.O. Box 425

Charleston, WV 25322-0425

Name

Address

Account #:

City

State

Zip

WV/SEV-401W

ANNUAL WASTE COAL SEVERANCE TAX RETURN

rtL041 v 8Web

Taxpayers required to file electronically will no longer receive returns for the tax types subject to the mandatory requirement

by mail. Please visit for additional information.

Period Ending:

Due Date:

Extension Date:

M

M

D

D

Y

Y

Y

Y

Check if:

CONSOLIDATED

SEPARATE

FINAL

AMENDED

SCHEDULE E - REPORT OF WASTE COAL PRODUCTION FOR TAXABLE YEAR

KEY TO COUNTY FIPS CODES

County

Waste coal produced this year

Name of County of Production

FIPS Code

Round to nearest whole ton

001 Barbour

023 Grant

045 Logan

067 Nicholas

089 Summers

003 Berkeley

025 Greenbrier

047 McDowell

069 Ohio

091 Taylor

00

.

005 Boone

027 Hampshire

049 Marion

071 Pendleton

093 Tucker

007 Braxton

029 Hancock

051 Marshall

073 Pleasants

095 Tyler

00

009 Brooke

031 Hardy

053 Mason

075 Pocahontas

097 Upshur

.

011 Cabell

033 Harrison

055 Mercer

077 Preston

099 Wayne

00

013 Calhoun

035 Jackson

057 Mineral

079 Putnam

101 Webster

.

015 Clay

037 Jefferson

059 Mingo

081 Raleigh

103 Wetzel

017 Doddridge

039 Kanawha

061 Monongalia

083 Randolph

105 Wirt

00

.

019 Fayette

041 Lewis

063 Monroe

085 Ritchie

107 Wood

021 Gilmer

043 Lincoln

065 Morgan

087 Roane

109 Wyoming

00

.

TAX COMPUTATIONS

1.

Total Gross Value of Recovered and Processed Waste Coal

.

2.

Rate

0.025

3.

Tax Due Before Credits (Multiply Line 1 by Line 2)

.

4.

Total Credits (Schedule TC - Line 7 on Page 2)

.

5.

Net Amount of Tax (Line 3 minus Line 4) If Line 4 is greater than Line 3, Enter 0

.

6.

Total Payments made for the Period Covered by this Return and any Credit from Prior Years Overpayment

.

7.

Balance of Tax Due (Line 5 minus Line 6)

.

8.

NON-WAIVABLE INTEREST

.

9.

ADDITIONS TO TAX

.

10.

PENALTY FOR UNDERPAYMENT OF ESTIMATED TAX

.

11.

TOTAL TAX AND LATE FILING CHARGES DUE (Add Lines 7 through 10)

.

12.

Overpayment Amount (Line 6 minus Line 5) If Line 5 is greater than Line 6, enter 0

.

13.

Amount of Line 12 to be Credited to Next Year's Tax

.

14.

Amount of Line 12 to be Refunded (Line 12 minus Line 13)

.

MAIL TO: WEST VIRGINIA STATE TAX DEPARTMENT

Tax Account Administration Div

P.O. Box 425, Charleston, WV 25322-0425

FOR ASSISTANCE CALL (304) 558-3333 TOLL FREE (800) 982-8297

For more information visit our web site at:

G

0

6

2

0

0

8

0

1

W

File online at https://mytaxes.wvtax.gov

1

1 2

2