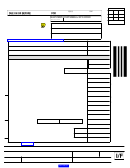

BOE-100-B (S2F) REV. 21 (1-12)

STATE OF CALIFORNIA

BOARD OF EQUALIZATION

SCHEDULE A: CHANGE IN CONTROL OF A LEGAL ENTITY

(Pursuant to California Revenue and Taxation Code section 64(c))

Complete this schedule if you answered YES to both parts of either question 1 or 2 on page 1 (S1)

Complete one Schedule A for each entity acquired (see instructions)

Please answer ALL of the items below.

1a. Provide the following information about the ACQUIRED legal entity:

NAME OF THE ACQUIRED LEGAL ENTITY

CORPORATE/LIMITED LIABILITY COMPANY IDENTIFICATION NUMBER (issued by CA Secretary of State)

PARTNERSHIP IDENTIFICATION NUMBER (FEIN)

MAILING ADDRESS (street, PO box, city, state, and zip code)

CONTACT PERSON

TELEPHONE NUMBER

EMAIL ADDRESS

(

)

1b. Provide the following information about the ACQUIRING legal entity:

NAME OF THE ACQUIRING PERSON OR LEGAL ENTITY

CORPORATE/LIMITED LIABILITY COMPANY IDENTIFICATION NUMBER (issued by CA Secretary of State)

PARTNERSHIP IDENTIFICATION NUMBER (FEIN)

MAILING ADDRESS (street, PO box, city, state, and zip code)

CONTACT PERSON

TELEPHONE NUMBER

EMAIL ADDRESS

(

)

2. Provide the following information about the change in control of the

acquired

legal entity.

a. Date ownership control (i.e., transfer of more than 50 percent of the ownership interests) was obtained:

(month/day/year)

b. Description of the transaction. If an indirect change in control, identify all entities involved.

3. Identify the ownership interests held by the person or legal entity in the

acquired

legal entity before and after the date of the

change in control. Attach an additional sheet if necessary. If any interest(s) is held by a trust, indicate whether the trust is

revocable or irrevocable and identify the beneficiaries of the trust.

PERCENTAGE OF INTEREST HELD

*

BEFORE

AFTER

NAME OF PERSON OR LEGAL ENTITY

ACQUISITION DATE

ACQUISITION DATE

*The acquiring person or legal entity must identify the percentage interest they held before and after the acquisition.

(Continued on reverse)

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10