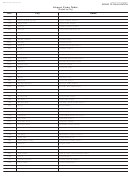

BOE-810-FTB (S3) REV. 2 (1-10)

STATE OF CALIFORNIA

PRODUCT CODE TABLE

BOARD OF EQUALIZATION

(Sorted by Product Description)

FORMS THE PRODUCT CODES ARE REPORTED ON

PRODUCT

DIESEL PROGRAMS

MVF

INFORMATIONAL REPORTS

CODE DESCRIPTION

059

MVF

Taxable

Pentanes, isopentane and pentane mixtures

X

X

X

059

054

Accountable

Reportable

Propane (LPG)

X

X

054

075

MVF

Reportable

Propylene

X

X

X

075

223

MVF

Taxable

Raffinate

X

X

X

223

071

MVF

Taxable

Reformulated gasoline with MTBE

X

X

X

X

071

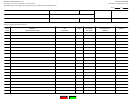

175

Diesel

Other

Residual Fuel Oil

X

X

X

175

285

Diesel

Taxable

Soy oil

X

X

X

X

X

X

X

X

X

285

121

MVF

Taxable

Tertiary amyl methyl ether (TAME)

X

X

X

121

199

MVF

Taxable

Toluene

X

X

X

199

100

Diesel

Reportable

Transmix

X

X

X

100

100

MVF

Taxable

Transmix containing gasoline

X

X

X

100

092

Diesel

Other

Undefined (other) products

X

X

X

092

092

MVF

Other

Undefined (other) products

X

X

X

092

091

Diesel

Other

Waste oil

X

X

X

091

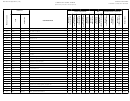

Product Type:

Accountable—Product is only applicable to terminal operators and petroleum

carriers;

includes products that are neither motor vehicle fuel nor diesel fuel.

�

Diesel—Product is any liquid that is commonly or commercially known or sold as a fuel that is suitable for use in a diesel powered highway vehicle; includes biodiesel.

�

MVF—Product is gasoline and aviation

gasoline;

gasoline includes both finished gasoline and gasoline blendstocks and gasohol.

�

Jet—Product is aircraft jet fuel; any inflammable liquid which is used to or sold for use in propelling aircraft operated by a jet or turbine-type engine.

�

Product Reporting—all products must be reported by terminal operators and petroleum carriers. The following grouping also applies to motor vehicle fuel suppliers, diesel fuel suppliers, aircraft jet fuel dealers, train operators, exempt bus operators, and diesel

fuel claimants.

�

Taxable—Includes motor vehicle fuel, diesel fuel, and aircraft jet fuel sold by aircraft jet fuel dealers. All products must be reported on the applicable tax form.

�

Reportable—Restricted to suppliers, terminal operators, and petroleum carriers. All products must be reported on the applicable tax form, even though they are not taxable. Reportable products include, but are not limited to, aircraft jet fuel (when not reported

by an aircraft jet fuel dealer), ethanol, and kerosene.

�

Other—Includes products that are only reportable by suppliers when blended with gasoline or diesel fuel or when they are labeled for sale or sold as diesel fuel or gasoline. All products must be reported by terminal operators and petroleum carriers on the

applicable tax form.

�

Exempt—Restricted to dyed diesel fuel product codes. All products must be reported on the applicable tax form, even though they are exempt. The term “exempt” applies to the sales and purchases of the product, not its use. Use of these products on-highway

is taxable, but may not be allowable by law.

�

1

1 2

2 3

3