Reset Form

Form 2, Page 7 - 2011

Social Security Number:

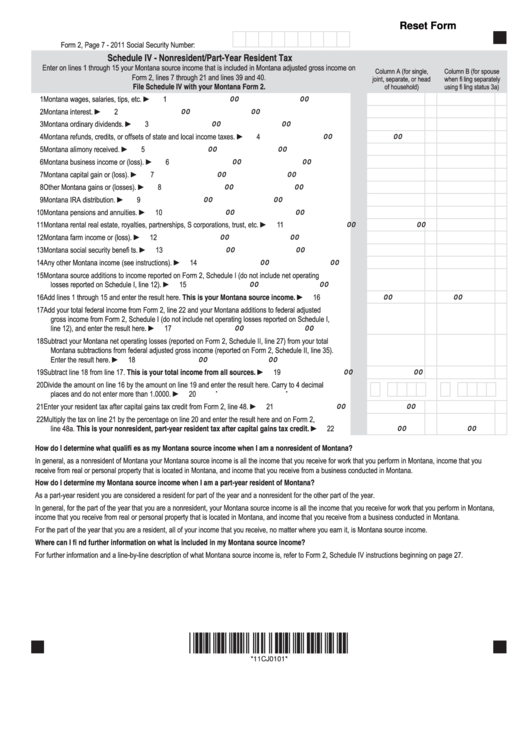

Schedule IV - Nonresident/Part-Year Resident Tax

Enter on lines 1 through 15 your Montana source income that is included in Montana adjusted gross income on

Column A (for single,

Column B (for spouse

Form 2, lines 7 through 21 and lines 39 and 40.

joint, separate, or head

when fi ling separately

File Schedule IV with your Montana Form 2.

of household)

using fi ling status 3a)

►

1 Montana wages, salaries, tips, etc.

1

00

00

►

2 Montana interest.

2

00

00

►

3 Montana ordinary dividends.

3

00

00

►

4 Montana refunds, credits, or offsets of state and local income taxes.

4

00

00

►

5 Montana alimony received.

5

00

00

►

6 Montana business income or (loss).

6

00

00

►

7 Montana capital gain or (loss).

7

00

00

►

8 Other Montana gains or (losses).

8

00

00

►

9 Montana IRA distribution.

9

00

00

►

10 Montana pensions and annuities.

10

00

00

►

11 Montana rental real estate, royalties, partnerships, S corporations, trust, etc.

11

00

00

►

12 Montana farm income or (loss).

12

00

00

►

13 Montana social security benefi ts.

13

00

00

►

14 Any other Montana income (see instructions).

14

00

00

15 Montana source additions to income reported on Form 2, Schedule I (do not include net operating

►

losses reported on Schedule I, line 12).

15

00

00

This is your Montana source income. ►

16 Add lines 1 through 15 and enter the result here.

16

00

00

17 Add your total federal income from Form 2, line 22 and your Montana additions to federal adjusted

gross income from Form 2, Schedule I (do not include net operating losses reported on Schedule I,

►

line 12), and enter the result here.

17

00

00

18 Subtract your Montana net operating losses (reported on Form 2, Schedule II, line 27) from your total

Montana subtractions from federal adjusted gross income (reported on Form 2, Schedule II, line 35).

►

Enter the result here.

18

00

00

This is your total income from all sources. ►

19 Subtract line 18 from line 17.

19

00

00

20 Divide the amount on line 16 by the amount on line 19 and enter the result here. Carry to 4 decimal

.

.

►

places and do not enter more than 1.0000.

20

►

21 Enter your resident tax after capital gains tax credit from Form 2, line 48.

21

00

00

22 Multiply the tax on line 21 by the percentage on line 20 and enter the result here and on Form 2,

This is your nonresident, part-year resident tax after capital gains tax credit. ►

line 48a.

22

00

00

How do I determine what qualifi es as my Montana source income when I am a nonresident of Montana?

In general, as a nonresident of Montana your Montana source income is all the income that you receive for work that you perform in Montana, income that you

receive from real or personal property that is located in Montana, and income that you receive from a business conducted in Montana.

How do I determine my Montana source income when I am a part-year resident of Montana?

As a part-year resident you are considered a resident for part of the year and a nonresident for the other part of the year.

In general, for the part of the year that you are a nonresident, your Montana source income is all the income that you receive for work that you perform in Montana,

income that you receive from real or personal property that is located in Montana, and income that you receive from a business conducted in Montana.

For the part of the year that you are a resident, all of your income that you receive, no matter where you earn it, is Montana source income.

Where can I fi nd further information on what is included in my Montana source income?

For further information and a line-by-line description of what Montana source income is, refer to Form 2, Schedule IV instructions beginning on page 27.

*11CJ0101*

*11CJ0101*

1

1