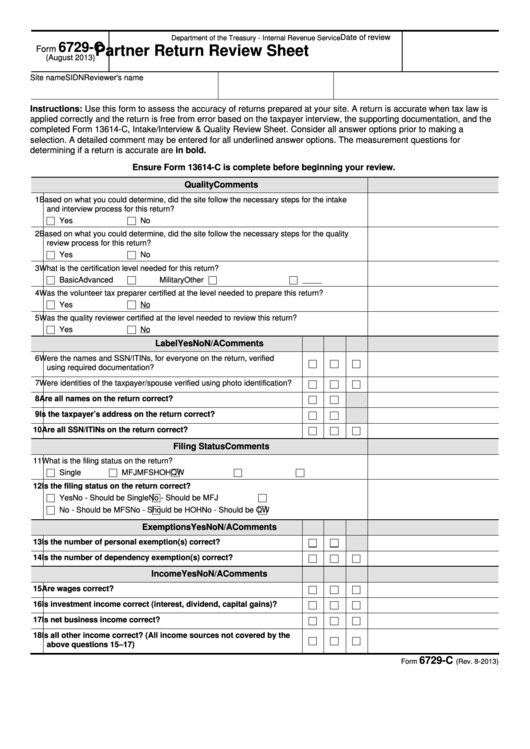

Date of review

Department of the Treasury - Internal Revenue Service

6729-C

Partner Return Review Sheet

Form

(August 2013)

Site name

SIDN

Reviewer's name

Instructions: Use this form to assess the accuracy of returns prepared at your site. A return is accurate when tax law is

applied correctly and the return is free from error based on the taxpayer interview, the supporting documentation, and the

completed Form 13614-C, Intake/Interview & Quality Review Sheet. Consider all answer options prior to making a

selection. A detailed comment may be entered for all underlined answer options. The measurement questions for

determining if a return is accurate are in bold.

Ensure Form 13614-C is complete before beginning your review.

Quality

Comments

1 Based on what you could determine, did the site follow the necessary steps for the intake

and interview process for this return?

Yes

No

2 Based on what you could determine, did the site follow the necessary steps for the quality

review process for this return?

Yes

No

3 What is the certification level needed for this return?

Basic

Advanced

Military

Other

4 Was the volunteer tax preparer certified at the level needed to prepare this return?

Yes

No

5 Was the quality reviewer certified at the level needed to review this return?

Yes

No

Label

Yes No N/A

Comments

6 Were the names and SSN/ITINs, for everyone on the return, verified

using required documentation?

7 Were identities of the taxpayer/spouse verified using photo identification?

8 Are all names on the return correct?

9 Is the taxpayer’s address on the return correct?

10 Are all SSN/ITINs on the return correct?

Filing Status

Comments

11 What is the filing status on the return?

Single

MFJ

MFS

HOH

QW

12 Is the filing status on the return correct?

Yes

No - Should be Single

No - Should be MFJ

No - Should be MFS

No - Should be HOH

No - Should be QW

Exemptions

Yes No N/A

Comments

13 Is the number of personal exemption(s) correct?

14 Is the number of dependency exemption(s) correct?

Income

Yes No N/A

Comments

15 Are wages correct?

16 Is investment income correct (interest, dividend, capital gains)?

17 Is net business income correct?

18 Is all other income correct? (All income sources not covered by the

above questions 15–17)

6729-C

Catalog Number 43859X

Form

(Rev. 8-2013)

1

1 2

2