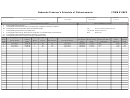

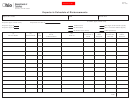

Form 4429, Page 2

Instructions for Form 4429, Retail Marine Diesel Dealer Schedule of Disbursements

General Instructions

Schedule Types - Check the appropriate box on page 1. Complete a separate schedule for each schedule type and product code.

6F

Gallons of dyed diesel/dyed biodiesel fuel sold or removed for tax-exempt purposes.

8

Gallons sold tax-free to U.S. government located in Michigan.

9

Gallons sold tax-free to state and /or local government in Michigan, including public schools. Undyed diesel, undyed biodiesel, and dyed biodiesel only.

Product Codes - Enter the appropriate code on page 1. See the Retail Marine Diesel Dealer Return Instructions or Treasury's Web site for a list of

product codes.

Column Instructions

Column (1) & (2):

Carrier - Enter the name and Federal Employer ID Number (FEIN) of the company that transports the product.

Column (3):

Mode of Transport - Enter the mode of transport. Use one of the following:

J = Truck

R = Rail

B = Barge

PL = Pipeline

S = Ship (Great Lakes or ocean marine vessel)

Column (4):

Point of Origin/Destination - Enter the location the product was transported from/to. When received into or from a terminal, the Terminal

Control Number (TCN) must be used.

Column (5) & (6):

Sold To - Enter name of purchaser and FEIN.

Column (7):

Date Shipped - Enter the date the product was shipped.

Column (8):

Document Number - Enter the bill of lading number from the manifest issued at the terminal when product is removed over the rack. In the

case of bulk plant removals, use the withdrawal bill of ladding number or invoice number.

Column (9):

Not Applicable (N/A)

Column (10):

Gross Gallons - Enter the gross amount of gallons disbursed.

Column (11):

Not Applicable (N/A)

1

1 2

2