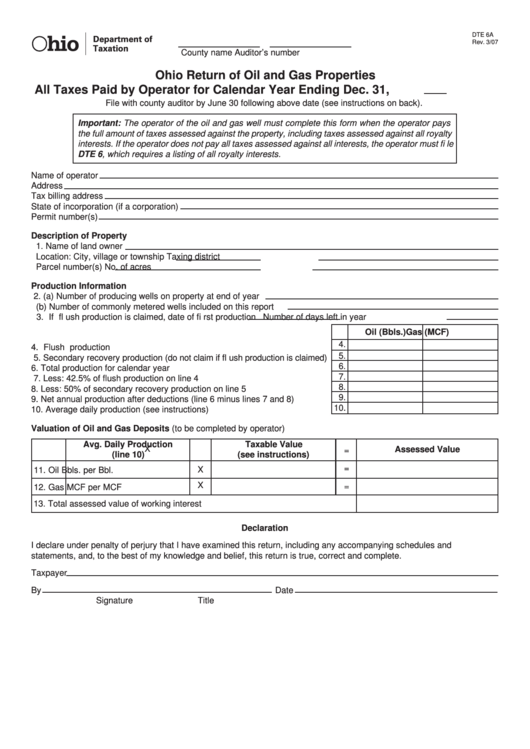

Reset Form

hio

DTE 6A

Department of

Rev. 3/07

Taxation

County name

Auditor’s number

Ohio Return of Oil and Gas Properties

All Taxes Paid by Operator for Calendar Year Ending Dec. 31,

File with county auditor by June 30 following above date (see instructions on back).

Important: The operator of the oil and gas well must complete this form when the operator pays

the full amount of taxes assessed against the property, including taxes assessed against all royalty

interests. If the operator does not pay all taxes assessed against all interests, the operator must fi le

DTE 6, which requires a listing of all royalty interests.

Name of operator

Address

Tax billing address

State of incorporation (if a corporation)

Permit number(s)

Description of Property

1. Name of land owner

Location: City, village or township

Taxing district

Parcel number(s)

No. of acres

Production Information

2. (a) Number of producing wells on property at end of year

(b) Number of commonly metered wells included on this report

3. If fl ush production is claimed, date of fi rst production

Number of days left in year

Oil (Bbls.)

Gas (MCF)

4.

4. Flush production ..........................................................................................

5.

5. Secondary recovery production (do not claim if fl ush production is claimed)

6.

6. Total production for calendar year ................................................................

7.

7. Less: 42.5% of fl ush production on line 4 ....................................................

8.

8. Less: 50% of secondary recovery production on line 5 ...............................

9.

9. Net annual production after deductions (line 6 minus lines 7 and 8) ...........

10.

10. Average daily production (see instructions) .................................................

Valuation of Oil and Gas Deposits (to be completed by operator)

Avg. Daily Production

Taxable Value

X

Assessed Value

=

(line 10)

(see instructions)

=

X

11. Oil

Bbls.

per Bbl.

X

=

12. Gas

MCF

per MCF

13. Total assessed value of working interest

Declaration

I declare under penalty of perjury that I have examined this return, including any accompanying schedules and

statements, and, to the best of my knowledge and belief, this return is true, correct and complete.

Taxpayer

By

Date

Signature

Title

1

1 2

2