4

Form 3520 (2013)

Page

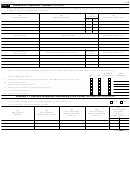

Part II

U.S. Owner of a Foreign Trust (see instructions)

(a)

(e)

20

(b)

(c)

(d)

Name of other foreign

Relevant Code

Address

Country of residence

Identification number, if any

trust owners, if any

section

(a)

(b)

(c)

21

Country code of country where foreign trust

Country code of country whose law governs the foreign trust

Date foreign trust was created

was created

22

Did the foreign trust file Form 3520-A for the current year? .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

Yes

No

If “Yes,” attach the Foreign Grantor Trust Owner Statement you received from the foreign trust.

If “No,” to the best of your ability, complete and attach a substitute Form 3520-A for the foreign trust.

See instructions for information on penalties.

23

Enter the gross value of the portion of the foreign trust that you are treated as owning at the end of the tax year

$

▶

Part III

Distributions to a U.S. Person From a Foreign Trust During the Current Tax Year (see instructions)

24

Cash amounts or FMV of property received, directly or indirectly, during the current tax year, from the foreign trust (exclude loans included on line 25).

(c)

(d)

(e)

(f)

(a)

(b)

FMV of property received

Description of

FMV of property

Excess of column (c)

Date of distribution

Description of property received

(determined on date of

property transferred,

transferred

over column (e)

distribution)

if any

Totals.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

$

▶

25 During the current tax year, did you (or a person related to you) receive a loan from a related foreign trust (including an

extension of credit upon the purchase of property from the trust)? .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

Yes

No

If “Yes,” complete columns (a) through (g) below for each such loan.

Note. You are considered to have received a loan if you (or a U.S. person related to you) were permitted the

uncompensated use of trust property (as described in section 643(i)). See instructions for additional information,

including how to complete columns (a) through (g) for such transactions.

(c)

(e)

(g)

(b)

(d)

(f)

Is the obligation a

(a)

Maximum term of

Amount treated as distribution

Date of original

Interest rate

FMV of qualified

“qualified obligation?”

FMV of loan proceeds

repayment of

from the trust (subtract

loan transaction

of obligation

obligation

column (f) from column (a))

obligation

Yes

No

Total .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

$

▶

26 With respect to each obligation you reported as a “qualified obligation” on line 25: Do you agree to extend the

period of assessment of any income or transfer tax attributable to the transaction, and any consequential income

tax changes for each year that the obligation is outstanding, to a date 3 years after the maturity date of the

obligation?

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

Yes

No

Note. Generally, you must answer “Yes” if you checked “Yes” in column (e) of line 25.

27 Total distributions received during the current tax year. Add line 24, column (f), and line 25, column (g)

.

.

$

▶

28 Did the trust, at any time during the tax year, hold an outstanding obligation of yours (or a person related to you)

that you reported as a “qualified obligation” in the current tax year? .

.

.

.

.

.

.

.

.

.

.

.

.

.

Yes

No

If “Yes,” complete columns (a) through (e) below for each obligation.

(d)

(e)

(b)

(c)

Does the loan still meet the

(a)

Amount of

Tax year

Amount of principal

criteria of a qualified

Date of original loan

interest payments

qualified obligation

payments made during

obligation?

transaction

made during

first reported

the tax year

the tax year

Yes

No

3520

Form

(2013)

1

1 2

2 3

3 4

4 5

5 6

6