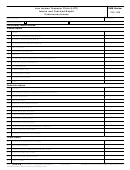

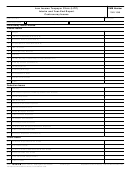

Instructions for Form 13424-B, Low Income Taxpayer Clinics (LITCs)

2012 Interim and Year-End Report Controversy Issues

Specific Instructions

Income Issues

Lines 1 through 14. Report on the appropriate line the number of cases worked during the reporting period where the taxpayer's

controversy involved the particular income issue. For example, a dispute involving wages where an employer failed to provide a Form

W-2 or 1099-MISC would be reported on line 1, Wages.

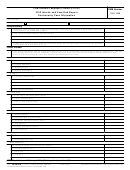

Deduction Issues

Lines 15 through 27. Report on the appropriate line the number of cases worked during the reporting period where the taxpayer's

controversy involved the particular deduction issue. For example, a dispute involving the allowability of a deduction for alimony would

be reported on line 15, Alimony.

Credit Issues

Lines 28 through 33. Report on the appropriate line the number of cases worked during the reporting period where the taxpayer's

controversy involved the particular credit issue. For example, a dispute involving a taxpayer's eligibility for an adoption credit would be

reported on line 33, Other Credits.

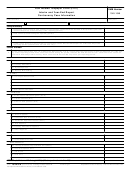

Status Issues

Lines 34 through 43. Report on the appropriate line the number of cases worked during the reporting period where the taxpayer's

controversy involved the particular status issue. For example, a dispute involving the taxpayer's eligibility to claim head of household

filing status would be reported on line 36, Filing status.

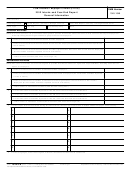

Tax / Refund / Return / Statute of Limitations Issues

Lines 44 through 51. Report on the appropriate line the number of cases worked during the reporting period where the taxpayer's

controversy involved the particular tax or refund or statute of limitations issue. For example, a dispute involving suspected fraud on the

part of a return preparer would be reported on line 45, Return Preparer Fraud.

Penalty Issues

Lines 52 through 54. Report on the appropriate line the number of cases worked during the reporting period where the taxpayer's

controversy involved the particular penalty issue. For example, a dispute involving the assessment of an accuracy-related penalty

would be reported on line 52, Other Civil Penalties.

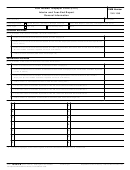

Collection Issues

Lines 55 through 60. Report on the appropriate line the number of cases worked during the reporting period where the taxpayer's

controversy involved the particular collection issue. For example, a dispute involving the release of a levy on a taxpayer's Social

Security benefits would be reported on line 60, Levies.

13424-B

Department of the Treasury - Internal Revenue Service

Form

(Rev. 11-2011) Catalog Number 53041F

1

1 2

2 3

3 4

4