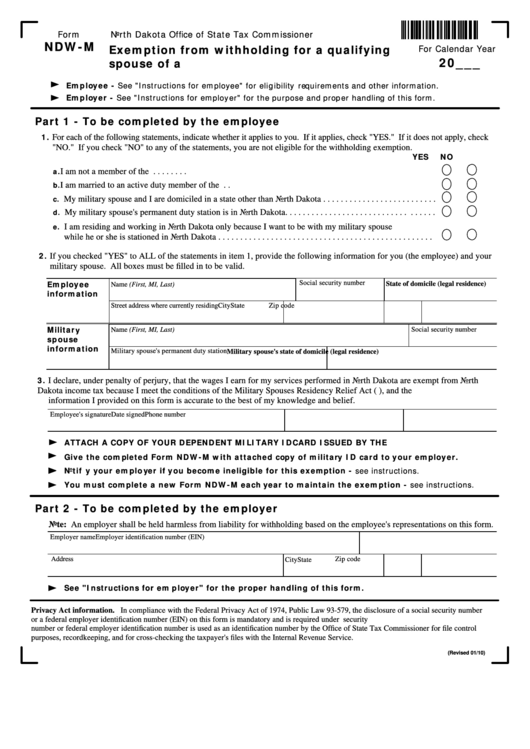

Form

North Dakota Office of State Tax Commissioner

NDW-M

Exemption from withholding for a qualifying

For Calendar Year

20___

spouse of a U.S. armed forces servicemember

Employee - See "Instructions for employee" for eligibility requirements and other information.

Employer - See "Instructions for employer" for the purpose and proper handling of this form.

Part 1 - To be completed by the employee

1.

For each of the following statements, indicate whether it applies to you. If it applies, check "YES." If it does not apply, check

"NO." If you check "NO" to any of the statements, you are not eligible for the withholding exemption.

YES

NO

a.

I am not a member of the U.S. armed forces . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

b.

I am married to an active duty member of the U.S. armed forces . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

c.

My military spouse and I are domiciled in a state other than North Dakota . . . . . . . . . . . . . . . . . . . . . . . . . .

d.

My military spouse's permanent duty station is in North Dakota. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

e.

I am residing and working in North Dakota only because I want to be with my military spouse

while he or she is stationed in North Dakota . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2.

If you checked "YES" to ALL of the statements in item 1, provide the following information for you (the employee) and your

military spouse. All boxes must be filled in to be valid.

Employee

Social security number

State of domicile (legal residence)

Name (First, MI, Last)

information

Street address where currently residing

City

State

Zip code

Military

Name (First, MI, Last)

Social security number

spouse

information

Military spouse's permanent duty station

Military spouse's state of domicile (legal residence)

3.

I declare, under penalty of perjury, that the wages I earn for my services performed in North Dakota are exempt from North

Dakota income tax because I meet the conditions of the Military Spouses Residency Relief Act (P.L. 111-97), and the

information I provided on this form is accurate to the best of my knowledge and belief.

Employee's signature

Date signed

Phone number

ATTACH A COPY OF YOUR DEPENDENT MILITARY ID CARD ISSUED BY THE U.S. DEPT. OF DEFENSE

Give the completed Form NDW-M with attached copy of military ID card to your employer.

Notify your employer if you become ineligible for this exemption - see instructions.

You must complete a new Form NDW-M each year to maintain the exemption - see instructions.

Part 2 - To be completed by the employer

Note: An employer shall be held harmless from liability for withholding based on the employee's representations on this form.

Employer name

Employer identification number (EIN)

Address

Zip code

City

State

See "Instructions for employer" for the proper handling of this form.

Privacy Act information. In compliance with the Federal Privacy Act of 1974, Public Law 93-579, the disclosure of a social security number

or a federal employer identification number (EIN) on this form is mandatory and is required under N.D.C.C. 57-38-56. A social security

number or federal employer identification number is used as an identification number by the Office of State Tax Commissioner for file control

purposes, recordkeeping, and for cross-checking the taxpayer's files with the Internal Revenue Service.

(Revised 01/10)

1

1 2

2