Form Reg-4-B - Financial Responsibility Bond Liquor Gallonage Tax

ADVERTISEMENT

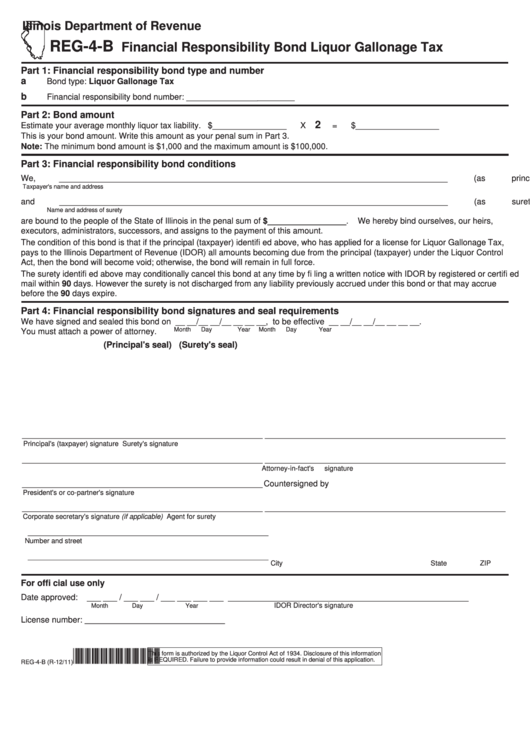

Illinois Department of Revenue

REG-4-B

Financial Responsibility Bond Liquor Gallonage Tax

Part 1: Financial responsibility bond type and number

a

Bond type: Liquor Gallonage Tax

b

Financial responsibility bond number:

_______________

________

Part 2: Bond amount

2

Estimate your average monthly liquor tax liability. $________________

X

=

$__________________

This is your bond amount. Write this amount as your penal sum in Part 3.

Note: The minimum bond amount is $1,000 and the maximum amount is $100,000.

Part 3: Financial responsibility bond conditions

We,

____________________________________________________________________________________

(as principal)

Taxpayer's name and address

and

____________________________________________________________________________________

(as surety)

Name and address of surety

are bound to the people of the State of Illinois in the penal sum of $_________________. We hereby bind ourselves, our heirs,

executors, administrators, successors, and assigns to the payment of this amount.

The condition of this bond is that if the principal (taxpayer) identifi ed above, who has applied for a license for Liquor Gallonage Tax,

pays to the Illinois Department of Revenue (IDOR) all amounts becoming due from the principal (taxpayer) under the Liquor Control

Act, then the bond will become void; otherwise, the bond will remain in full force.

The surety identifi ed above may conditionally cancel this bond at any time by fi ling a written notice with IDOR by registered or certifi ed

mail within 90 days. However the surety is not discharged from any liability previously accrued under this bond or that may accrue

before the 90 days expire.

Part 4: Financial responsibility bond signatures and seal requirements

We have signed and sealed this bond on __ __/__ __/__ __ __ __, to be effective __ __/__ __/__ __ __ __.

Month

Day

Year

Month

Day

Year

You must attach a power of attorney.

(Principal's seal)

(Surety's seal)

____________________________________________________

____________________________________________________

Principal's (taxpayer) signature

Surety's signature

____________________________________________________

____________________________________________________

Attorney-in-fact's signature

____________________________________________________

Countersigned by

President's or co-partner's signature

____________________________________________________

____________________________________________________

Corporate secretary's signature (if applicable)

Agent for surety

____________________________________________________

Number and street

____________________________________________________

City

State

ZIP

For offi cial use only

Date approved:

___ ___ / ___ ___ / ___ ___ ___ ___

____________________________________________________

IDOR Director's signature

Month

Day

Year

License number:

________________________________

*145901110*

This form is authorized by the Liquor Control Act of 1934. Disclosure of this information

is REQUIRED. Failure to provide information could result in denial of this application.

REG-4-B (R-12/11)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2