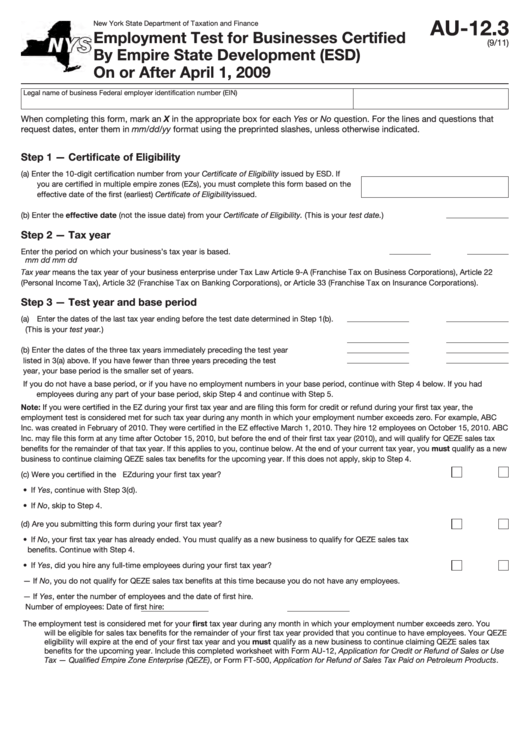

AU-12.3

New York State Department of Taxation and Finance

Employment Test for Businesses Certified

(9/11)

By Empire State Development (ESD)

On or After April 1, 2009

Legal name of business

Federal employer identification number (EIN)

When completing this form, mark an X in the appropriate box for each Yes or No question. For the lines and questions that

request dates, enter them in mm/dd/yy format using the preprinted slashes, unless otherwise indicated.

Step 1 — Certificate of Eligibility

(a)

Enter the 10-digit certification number from your Certificate of Eligibility issued by ESD. If

you are certified in multiple empire zones (EZs), you must complete this form based on the

effective date of the first (earliest) Certificate of Eligibility issued. ............................................

(b) Enter the effective date (not the issue date) from your Certificate of Eligibility. (This is your test date.) .........................

Step 2 — Tax year

Enter the period on which your business’s tax year is based. ........................................................................

through

mm

dd

mm

dd

Tax year means the tax year of your business enterprise under Tax Law Article 9-A (Franchise Tax on Business Corporations), Article 22

(Personal Income Tax), Article 32 (Franchise Tax on Banking Corporations), or Article 33 (Franchise Tax on Insurance Corporations).

Step 3 — Test year and base period

(a)

Enter the dates of the last tax year ending before the test date determined in Step 1(b). ....

(This is your test year.)

(b) Enter the dates of the three tax years immediately preceding the test year

listed in 3(a) above. If you have fewer than three years preceding the test

year, your base period is the smaller set of years.

If you do not have a base period, or if you have no employment numbers in your base period, continue with Step 4 below. If you had

employees during any part of your base period, skip Step 4 and continue with Step 5.

Note: If you were certified in the EZ during your first tax year and are filing this form for credit or refund during your first tax year, the

employment test is considered met for such tax year during any month in which your employment number exceeds zero. For example, ABC

Inc. was created in February of 2010. They were certified in the EZ effective March 1, 2010. They hire 12 employees on October 15, 2010. ABC

Inc. may file this form at any time after October 15, 2010, but before the end of their first tax year (2010), and will qualify for QEZE sales tax

benefits for the remainder of that tax year. If this applies to you, continue below. At the end of your current tax year, you must qualify as a new

business to continue claiming QEZE sales tax benefits for the upcoming year. If this does not apply, skip to Step 4.

(c) Were you certified in the EZ during your first tax year? ..........................................................................................

Yes

No

• If Yes, continue with Step 3(d).

• If No, skip to Step 4.

(d) Are you submitting this form during your first tax year? .........................................................................................

Yes

No

• If No, your first tax year has already ended. You must qualify as a new business to qualify for QEZE sales tax

benefits. Continue with Step 4.

• If Yes, did you hire any full-time employees during your first tax year? ..............................................................

Yes

No

— If No, you do not qualify for QEZE sales tax benefits at this time because you do not have any employees.

— If Yes, enter the number of employees and the date of first hire.

Number of employees:

Date of first hire:

The employment test is considered met for your first tax year during any month in which your employment number exceeds zero. You

will be eligible for sales tax benefits for the remainder of your first tax year provided that you continue to have employees. Your QEZE

eligibility will expire at the end of your first tax year and you must qualify as a new business to continue claiming QEZE sales tax

benefits for the upcoming year. Include this completed worksheet with Form AU-12, Application for Credit or Refund of Sales or Use

Tax — Qualified Empire Zone Enterprise (QEZE), or Form FT-500, Application for Refund of Sales Tax Paid on Petroleum Products.

1

1 2

2 3

3 4

4