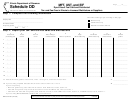

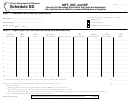

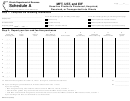

Schedule D (Form Rmft-32) - Mft, Ust, And Eif Gasoline Products Sold And Distributed Tax- And Fee-Free In Illinois To Licensed Distributors And Receivers Page 2

ADVERTISEMENT

General Instructions

Step-by-Step Instructions

This schedule is used for reporting the

Step 1: Complete the following

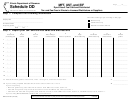

Line 11 - Add the invoiced gallons reported in

following taxes:

information

Column 9, Lines 1 through 10.

• Motor Fuel Tax (MFT)

Write your company name, your license number,

Line 12 - If you are filing more than one Schedule D,

• Underground Storage Tank Tax (UST)

and the period for which you are reporting. Check

group together all Schedules D that report

• Environmental Impact Fee (EIF)

the box next to the tax/fee type you are listing on

• MFT-free gallons only. Add Lines 11 from this

this page. Report one tax/fee type only per page.

group, and write the total on Line 12 of the last

Which gasoline products must be

page. Also write this amount on Form RMFT-5,

reported on this shedule?

Step 2: Report your tax- and fee-free

Line 8a, Column 1.

sales

• UST- and EIF-free gallons only. Add Lines 11

The gasoline products that must be reported on

from this group, and write the total on Line 12 of

this schedule are all products commonly or

Lines 1 through 10 —

the last page. Also write this amount on

commercially known or sold as gasoline (including

Form RMFT-5-US, Line 8, Column 1.

casing-head and absorption or natural gasoline),

Column 1 - Write the month, day, and year of the

• both MFT- and UST-/EIF-free gallons. Add

gasohol, motor benzol, or motor benzene, regard-

invoice.

Lines 11 from this group, and write the total on

less of their classification or use.

Line 12 of the last page. Also write this amount

Column 2 - Write the invoice number.

When do I file this schedule?

on Form RMFT-5, Line 8a, Column 1 and

Form RMFT-5-US, Line 8, Column 1.

Column 3 - Write the carrier’s complete business

You must file Schedule D with Form RMFT-5 if you

name.

are reporting MFT-free gallons only or both MFT-

and UST-/EIF-free gallons.

Column 4 - Write the bill of lading or manifest

number.

You must file Schedule D with Form RMFT-5-US if

you are reporting only UST-/EIF-free gallons.

Column 5 - Write the purchaser’s complete name.

What records must I keep?

Column 6 - Write the name of the Illinois city from

You are required by law to keep books and

which the gasoline product originated.

records showing all purchases, receipts, losses

through any cause, sales, distributions, and use of

Column 7 - Write the name of the Illinois city to

fuels.

which the gasoline product was delivered.

What if I need additional assistance?

Column 8 - Write the purchaser’s Illinois license

number.

If you have questions about this schedule, write to us

at Motor Fuel Tax, Illinois Department of Revenue,

Column 9 - Write the number of invoiced gallons.

P .O. Box 19477, Springfield, Illinois 62794-9477, or

call our Springfield office weekdays between 8 a.m.

and 4:30 p.m. at 217 782-2291.

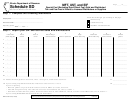

This form is authorized as outlined by the Motor Fuel Tax Law and the Environmental Impact Fee Law. Disclosure of this information is REQUIRED.

RMFT-32 back (R-02/00)

Failure to provide information could result in a penalty. This form has been approved by the Forms Management Center.

IL-492-1538

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2