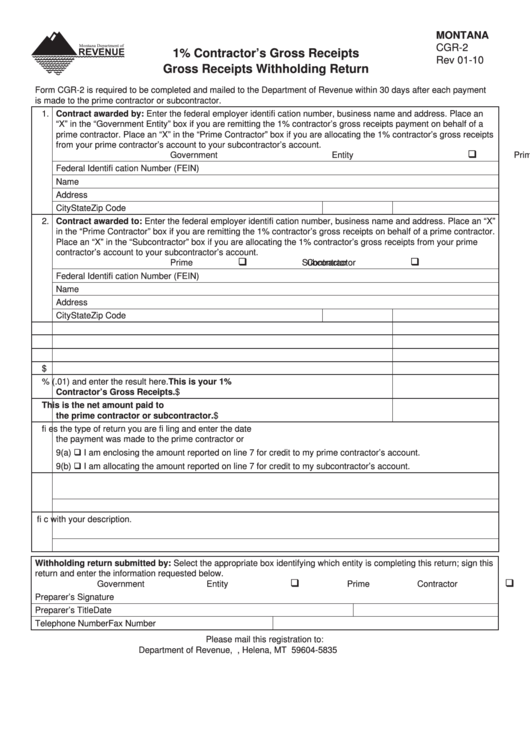

MONTANA

CGR-2

1% Contractor’s Gross Receipts

Rev 01-10

Gross Receipts Withholding Return

Form CGR-2 is required to be completed and mailed to the Department of Revenue within 30 days after each payment

is made to the prime contractor or subcontractor.

1. Contract awarded by: Enter the federal employer identifi cation number, business name and address. Place an

“X” in the “Government Entity” box if you are remitting the 1% contractor’s gross receipts payment on behalf of a

prime contractor. Place an “X” in the “Prime Contractor” box if you are allocating the 1% contractor’s gross receipts

from your prime contractor’s account to your subcontractor’s account.

Government Entity

Prime Contractor

Federal Identifi cation Number (FEIN)

Name

Address

City

State

Zip Code

2. Contract awarded to: Enter the federal employer identifi cation number, business name and address. Place an “X”

in the “Prime Contractor” box if you are remitting the 1% contractor’s gross receipts on behalf of a prime contractor.

Place an “X” in the “Subcontractor” box if you are allocating the 1% contractor’s gross receipts from your prime

contractor’s account to your subcontractor’s account.

Prime Contractor

Subcontractor

Federal Identifi cation Number (FEIN)

Name

Address

City

State

Zip Code

3. Enter the Government Issued Purchase Order Number here. ......................................3.

4. Enter the contract award date here. ..............................................................................4.

_____/_____/20___

5. Enter the month and year this payment was earned. ....................................................5.

_____/20___

6. Enter the gross dollar amount due to the prime contractor or subcontractor here. .......6. $

7. Multiply the amount on line 6 by 1% (.01) and enter the result here. This is your 1%

Contractor’s Gross Receipts. .....................................................................................7. $

8. Subtract line 7 from line 6 and enter the result here. This is the net amount paid to

the prime contractor or subcontractor. .....................................................................8. $

9. Check the box below that identifi es the type of return you are fi ling and enter the date

the payment was made to the prime contractor or subcontractor..................................9. _____/_____/20___

9(a) I am enclosing the amount reported on line 7 for credit to my prime contractor’s account.

9(b) I am allocating the amount reported on line 7 for credit to my subcontractor’s account.

10. Enter a description of the work performed under this contract.

11. Enter the location in Montana where this work is performed. Be specifi c with your description.

Withholding return submitted by: Select the appropriate box identifying which entity is completing this return; sign this

return and enter the information requested below.

Government Entity

Prime Contractor

Subcontractor

Preparer’s Signature

Preparer’s Title

Date

Telephone Number

Fax Number

Please mail this registration to:

Department of Revenue, P.O. Box 5835, Helena, MT 59604-5835

1

1